🚨 11.11.22 🚨

The fall of FTX is nearly complete, and it appears to be the result of a ten-person cabal in the Bahamas

I think I’m getting the hang of this daily newsletter thing. I also think the family I have abandoned is unlikely to take me back whenever this saga reaches its first intermission.

Coming into day three of the end of the (crypto) world, where did we stand?

FTX sits on the brink of bankruptcy;

Binance, Coinbase, and likely others have (rightfully) stuffed their helping hands deep inside their pockets;

Few at FTX had any idea what was going on, for how long, and to what extent;

The FTX legal and compliance team is now a skeleton crew;

FTX investors are marking their investment down to zero and eliminating any trace of FTX from their online profiles;

And Gary Gensler believes he was made for this moment, when he actually made this moment.

Today brought little closure, more questions, and continued carnage. The chaos will subside eventually.

The Day After The Day After

Numbers started to surface yesterday, and some have crystallized today. FTX had $16B in customer assets, $10B of which was lent out to Alameda. For you quick math wizards at home, yes: they lent out more than half of their customer deposits to themselves before losing it all. He called this a ‘poor judgment call.’

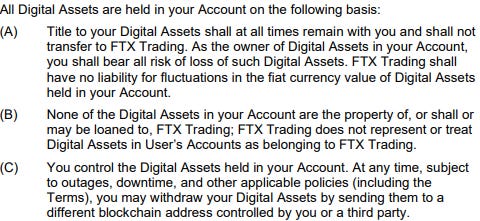

This despite FTX’s own terms of service specifically stating that the title to customer assets is owned by the customer, at all times. This is a departure from the terms found in the Celsius and Voyager documents, which legally allowed them to lend or rehypothecate customer assets for yield. What FTX did is legitimately criminal, the definition of theft. The window for a bailout is over; the bankruptcy filing is a matter of when, not if; the criminal proceedings are inevitable. There will be no redemption arc.

SBF took to Twitter to apologize and share details on what he is doing to make customers right. Except his ‘apology’ reads like a blatant lie and his 20-tweet thread raised more questions than answers. He even had the audacity to hint that CZ and Binance, of all people, acted out of pocket. This fucking guy.

The streets are also saying that SBF might be the person responsible for the SushiSwap rug back in 2020. The writing styles are coming up pretty, pretty, pretty similar on the forensics scans. Probably a coincidence … but this is SBF we’re talking about – every thread you pull on takes you down an even darker hole.

Binance simply spent the day delivering on their promise to share their reserve wallet addresses and complete their proof-of-reserves commitment. Everybody in the world can now see that Binance holds $69B in deposits and reserves, held in bitcoin, ether, and other tokens.

Brian Armstrong, founder and CEO of Coinbase, hit CNBC with a suit and a no-nonsense attitude, before stating the obvious about FTX: ‘I don’t know why investors would put money into this now.’

The Recap

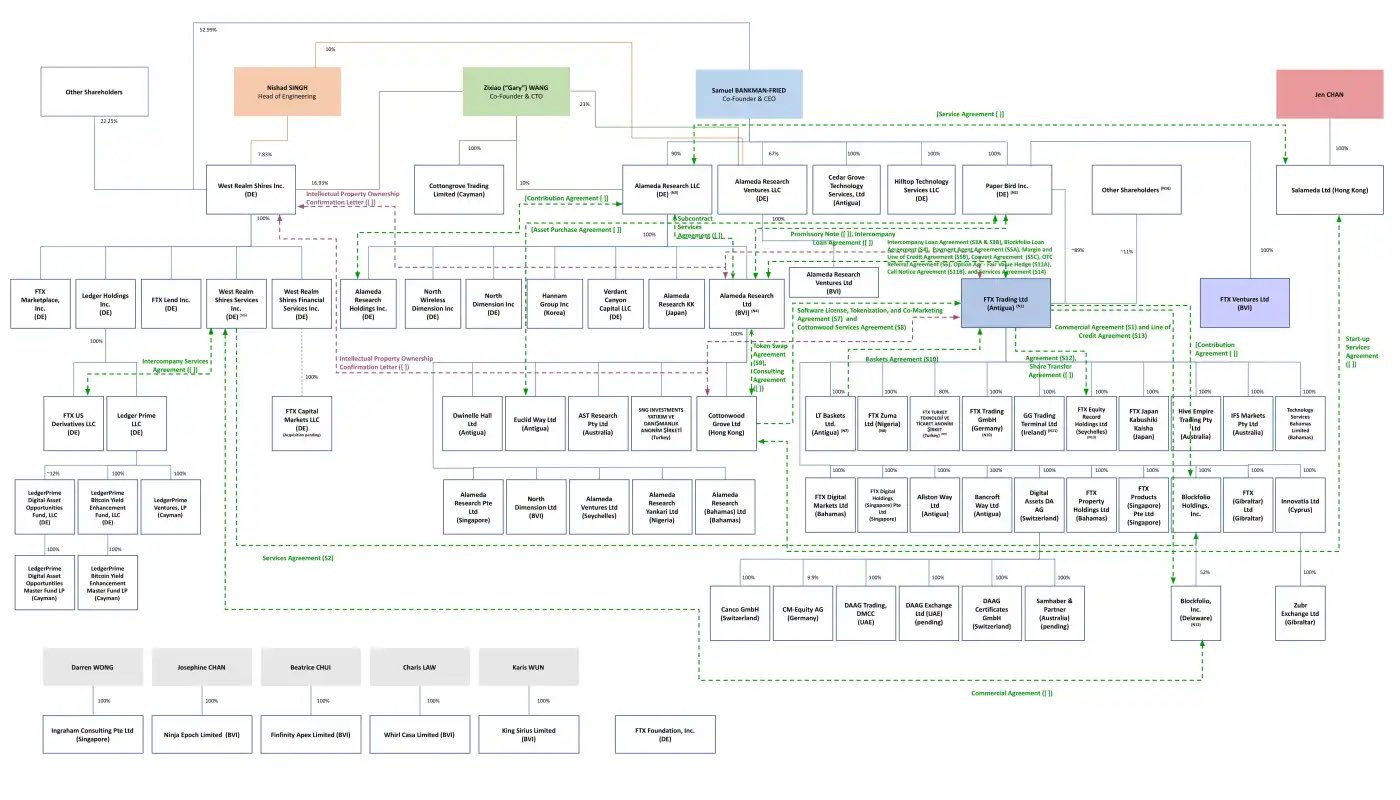

SBF explicitly lent FTX customer funds to Alameda while Caroline Ellison and Sam Trabucco ran the trading firm, underestimating the possibility and speed of user withdrawals. Most of the (billions and billions) of capital raised by FTX in the last year-plus was done so that Alameda could further borrow against large token positions. All of this was done with almost no oversight, which is unsurprising once you see the FTX org chart. I mean, look at this thing – it might as well be the plumbing blueprint for a condominium complex:

The Bailouts. When FTX was running around bailing everybody out several months ago, SBF was in front of newsroom cameras declaring the company’s strong financial standing. In reality, he was lending customer funds to Alameda, secured by FTT and the Robinhood shares FTX had purchased, to keep the trading firm from blowing up itself and quietly laying off individuals who questioned him. He had one of his minions do the cutting, having them tell those let go that they were a ‘bad culture fit.’ Then he would get back up on camera and boast about avoiding the plague of layoffs hitting every other major player in the industry.

The Cabal. ‘The whole operation was run by a gang of kids in the Bahamas.’ That quote sums it up pretty nicely. The details are a bit … less nice. SBF has been living in the Bahamas with nine roommates in a $35M penthouse, and FTX owns more than $200M of property on the island. The group includes Caroline Ellison of Alameda Research and FTX’s CTO, Director of Engineering, and six other employees. SBF and the two tech leads had complete control of the exchange’s code, allowing them to change the engine and numbers without anyone else noticing. And the ten individuals are, or used to be, paired up in romantic relationships with each other; SBF and Caroline, specifically, have been together at times. I can’t imagine how things didn’t go wrong sooner.

The Layer-1s. Two of the most hyped and well-funded new Layer-1 blockchains to launch this year, Aptos and Sui, were both backed by FTX. Apparently, SBF and friends were building many of the protocols launching on those new networks, raking in all of the participation incentives (without the Aptos and Sui teams knowing), and planning to use those funds to secure even more collateral for Alameda’s trading engine. Countless projects are tainted or ruined because of the involvement of SBF and friends.

The Cesspool. Over the last several years, SBF quietly invested more than $500M into top-tier venture funds, including Sequoia Capital, Paradigm, and Multicoin. If those names sound familiar, they should: they are all investors in FTX. Even if you assume best intentions on the side of the venture firms, it’s a bad look in a week full of them for everybody involved.

The Lies and Deception. As chaos took control this week, employees in charge of their own departments at FTX and who were pushing back on SBF’s broader intention of keeping FTX running were removed from internal Slack chats. One by one, dissenters were exiled from the organization. That culminated in the departure of the legal and compliance teams on Wednesday, and several employees taking to Twitter on Thursday to offer the public what SBF wouldn’t – real-time transparency. Until they were also booted from the company.

Thursday began with SBF tweeting that FTX had enough assets to cover customer deposits and that FTX.US was not financially impacted by everything going on. Within hours, it became clear that neither of those proclamations were true: FTX did not have the assets to cover customer deposits and leaked Slack messages confirmed that FTX.US was preparing to make payroll ‘at least in the next cycle,’ a frighteningly short time frame for a business that was supposedly unaffected. And then FTX.US warned that ‘trading may be halted’ in the coming days. You think?

The Contagion. The second-order effects are beginning to surface. BlockFi, bailed out by FTX five months ago after getting caught up in the Three Arrows Capital debacle, finds itself back in the eye of the storm, forced to announce that they are pausing client withdrawals. That’s the kiss of death in this industry. BlockFi appears to be the one player central to everything that has happened since May that can chalk this up to bad luck and a couple of poor business decisions more than outright fraud and greed.

Genesis shared that they had only $7M of losses from FTX and Alameda yesterday … but followed up today with some revised numbers: they have roughly $175M in locked funds in an FTX trading account. CoinShares also released a statement sharing $30M of exposure to FTX. This is only the beginning.

The Book. Michael Lewis, the author of The Big Short, has been following SBF around for a book prior to all of this happening. I think it’s fair to expect a bestseller.

Internal Sentiment Check-In

It is as bad as it can possibly be. I have no other way to share the details coming out from FTX employees other than to point you to the following tweet, which has been confirmed by other FTX employees.

Most FTX employees had no idea what was happening and were getting paid in crypto (including the FTT token) and on their FTX account. To make matters even worse, SBF offered all employees the opportunity to invest in FTX’s recent financings, up to $250K each … equity investments that are, obviously, worthless today. They believed that they were working for the bank of the future, led by a visionary founder; they not only lost their jobs this week, but also a significant amount (if not all) of their life savings.

It’s incredibly sad on a personal level, and not something that should be glossed over whenever the full story is unearthed.

Regulators … Juuuust A Bit Late

Gary Gensler continues to prop up ‘more regulation’ as the solution to this problem, running to the media. An an opportunity to climb the political ladder must never be missed.

Let us be clear: Gary Gensler will go down as the SEC Chair who missed FTX. He met with FTX in March and responded by going after lower-hanging targets of minimal consequence. He could have gone after FTX. He could have gone after FTT for being a security.

But ‘building the evidence … often takes time.’ If it takes less than a week for a company with a $40B enterprise value, $16B in customer deposits, and a cap table filled with trillions of investable capital to hit zero because of rampant fraud, I think eight months and the power of the US government can be reasonably expected to deliver more than *absolute silence*. Man, would it look bad if it came out that instead of investigating FTX, Gary was exploring ways to work with them on expanding in the US market …

Back to his CNBC appearance today, during which Gary pointed to the subpoena he served Terra’s Do Kwon back in September 2021 as evidence of his efforts … but to what end? No warnings or updates of substance followed that subpoena and Terra blew up less than nine months later, kicking off an industry-wide spiral. Approximately zero people were protected. Oh yeah, and that subpoena? It wasn’t for Terra but instead Mirror Protocol, a project buried hundreds of tickers deep on the list of the industry’s largest tokens. Gary failed to correct that misstatement live, what I will generously assume is an honest mistake. (That’s a joke. I’m not that generous.)

But hey, he got Kim Kardashian.

Maxine Waters, chair of the House Financial Services Committee, believes that this event ‘further highlights the urgent need for legislation.’ And right on cue, the Senators behind the crypto regulation bill that SBF backed, want to move forward with the bill. What. Are. We. Doing.

In no uncertain terms, the passing of this bill as-is would be plugging in bad legislation to fill a hole created by an inept approach to regulation. The bill would pigeonhole stablecoins and crypto intermediaries into existing securities and commodities frameworks, making it more difficult for US-based businesses to offer crypto services. We already know what that will cause! WE JUST SAW IT!

Crypto companies will increasingly choose to become offshore intermediaries, domiciling in jurisdictions that remove them from the US regulatory picture and give retail users in the US minimal protection, recourse, and transparency. FTX isn’t based in the Bahamas because they have beaches; it’s because they didn’t want to deal with the regulatory landscape in the US. How that isn’t the lesson being taken away from this is mind-boggling.

The other lesson is that decentralized crypto networks and the services built on top of them, eg DeFi, are not comparable to FTX. I am running out of ways to say this but they are built with open-source software; the incentive structures driving them and the activity they facilitate are entirely transparent and verifiable. I know it sounds crazy, but it’s true. A better system is actually possible.

On a positive note, Hester Peirce, the Commissioner of the SEC, went on Bloomberg today and admitted that this incident falls partly at the feet of the SEC because of their failure to provide regulatory clarity to the industry. Hester is her. I write two-thousand word blogs for fun and barely passed physics in high school so I would understand if you think I pick on Gary and the regulators for clicks. But smart, serious people can see through the facade, too. Gaslighting and poor policy has never been and will never be a viable strategy long-term.

The Best Threads

Jesse Powell, the former CEO of Kraken, delivered what I think is one of the best threads summarizing how many in the crypto industry feel. Recommended reading.

That one is followed closely by this one from Seth Rosenberg, a partner at Greylock. To outsiders, this event paints the picture of a broken industry. In reality, it only makes even more clear the need for decentralized institutions.

Some Fun

Nothing about SBF seems to be true, other than the fact that he never actually cared about crypto. Even his veganism has been called into question.

It really is stunning how Alameda failed:

I can confirm that this is true:

I haven’t *yet* but I’m keeping a growth mindset.

Source Code

FTX Tapped Into Customer Accounts to Fund Risky Bets, Setting Up Its Downfall

Exclusive: Behind FTX's fall, battling billionaires and a failed bid to save crypto

Binance Releases Wallet Addresses of $69B Crypto Reserve

FTX’s Bankman-Fried Quietly Invested More than $500 Million in Sequoia and Other VCs

Gensler pressed on FTX failure, warns investors to ‘be careful, beware.’

[Disclaimer: Any opinions expressed are solely my own and do not express the views or opinions of my employer. Because the information included in this newsletter is based on my personal opinion and experience, it should not be considered professional financial analysis or advice.]