[Note: this may be my last post for a few weeks/months as my wife and I are expecting our second child shortly. I’m sure the crypto markets will comply and stay perfectly calm and uneventful while I’m away.]

Update, 10:30 PM PT, March 13, 2023

Several hours after publication, the Federal Reserve, the Department of the Treasury, and the FDIC announced that they would be deploying emergency measures to shore up the banking system and backstop deposits at SVB. They also announced that Signature Bank would be closing and its depositors would also receive full support from the US government.

On one hand, this is good news, and helps avoid the longer-term catastrophe I touch on below. All SVB (and Signature) depositors will be made whole, effective tomorrow (Monday, March 13th, 2023).

Tens of thousands of companies will make payroll. Many in the startup and tech ecosystems, including countless SVBers, worked tirelessly over the weekend to find solutions to help companies and their employees stay afloat, including a clear message to the government about what was at stake with further inaction. Importantly, this is not a bail out, at least in the sense that you are probably thinking: the money made available to depositors immediately — largely startups and small businesses — will come from the US government, but will be ‘repaid’ once SVB and Signature complete the liquidation process of their assets.

This action is also frustrating, for several reasons. Had this support come several days ago — in the form of verbal support from the government that the money would be there, if needed, as a stop-gap to match duration risk — SVB likely could have been saved. But even more disappointing is that those who abandoned SVB and stoked the flames of fear to create a bank run almost out of thin air end up in the same position as all of those who remained calm and trusted SVB: everybody will be made whole, and taxpayers are on the hook for none of it.

What will be lost to many in this story and specifically this update: the closing of Signature Bank was the government seizing the opportunity to sweep them out with Silvergate under the cover of SVB, and blame it on ‘crypto.’ The announcement of Signature being closed surprised its own executive team, and was given the word count of a footnote and included in a statement focused on an entirely different company.

You can be skeptical of conspiracy theories. I am myself. Yet it seems highly plausible (and that is putting it kindly) that there was a coordinated effort to cripple the banking infrastructure for crypto. Hilariously (not hilarious), the government worked tirelessly to cut off crypto companies’ access to the fiat banking system — to protect the traditional banking system! — only for those efforts to result in the second-largest bank failure in US history, a bank immeasurably important to this country’s growth.

The three friendliest banks to crypto companies and their investors fell in a matter of five days, inclusive of a weekend. The third of those banks was put out to pasture as an afterthought.

The original post, shared at 12:35 PM PT on March 13th, 2023, is below.

This post was going to center around Silvergate, the crypto-friendly bank that announced it would be liquidating assets and shuttering its business after being targeted by anti-crypto politicians and experiencing its own bank run. Because this newsletter is usually a crypto one.

We’ll talk briefly about Silvergate because it played opening act to today’s headline — the second-largest bank failure in US history. The longer post on how Silvergate’s shuttering takes crypto banking infrastructure back to the pre-2017 dark ages may never see the light; its fallout dwarfs in comparison to the loss of SVB.

The big news: SVB, cornerstone institution to the innovation economy, is (very likely) no longer.

Before getting into what happened with SVB, I’m going to use the top of this post to share some thoughts on the bank and the people that made it what it was.

I spent more than five years at SVB. I would not be who I am and where I am today were it not for the team there. SVB not only provided me with incredible opportunities and insight into the inner workings (and importance) of the innovation ecosystem, but also showed what an organization can be when it prioritizes a great culture and even greater people. I feel genuinely lucky to have worked there and it was not a coincidence that the role I left for and currently sit in is one that kept me close to SVB.

Over those five years, I met and worked with hundreds of SVBers and talked with countless others. I did not one time come across somebody I wouldn’t get coffee with tomorrow. I certainly came across people I disagree with; pitching magic internet money every day in 2018 tended to do that. And even in those disagreeable moments, SVBers show up as learners, with a genuine curiosity to understand, and always looking to do the right thing.

None of the people I know at SVB deserve what has happened over the last few days. Few of them had even a remote chance of interacting with some of the problem assets that kicked off what ended up being a perfect storm of avoidable events.

And still, I have seen nothing but the utmost class from SVBers, including but not limited to efforts in helping their clients navigate the uncertainty of Thursday and Friday, even as their own futures were thrown into question. Many have spent the weekend to find solutions for (former?) clients. Some have even helped spin up SVB DAO, in an effort to use crypto rails to help support its startup customers. I’ve had SVBers ask me how I’m doing. They are good people and if this awful situation presents you the chance to hire one or many, consider your firm fortunate.

Empathy is a word I have seen all over social media describing SVB. It’s because for as large as SVB became, in both assets and employees, it never felt big and it always felt thoughtful. It never felt like the person across the office or computer screen didn’t have the company’s best intentions at heart. It certainly never felt like ‘a big bank’ despite clocking in at top-20 size. Instead, you always felt one hallway run-in or happy hour invite away from your newest friend at work. I doubt there are many 8,000-person organizations that can claim that kind of culture and back it up. Living your values is a corporate trope, yet it felt genuine at SVB.

I recognize that the law of large numbers ensures that my experience cannot reasonably be the case for everybody. I also recognize that I am what you would consider a ‘positive-leaning’ person, in that I try to find the good in people … usually. (We’re going to stop short of ‘happy-go-lucky’ — I’m happy, and I’m lucky, but I’m still a bit too cynical about credit card promotions, people who don’t like chocolate, and 15-minute delivery startup business models to exist in a constant state of jubilation.)

Still, I think I speak for most SVBers and clients of SVB when I say that their approach to building authentic relationships is unique for any company, not just a bank. The outpouring of support that the broader ecosystem has shown SVB since Friday has been incredible, and the emotional, visceral response from the community is one that almost no other bank could inspire. SVB was one of one.

As I begin the ‘substance’ section here, I want to make this very clear: though I have worked in and around the capital markets for my entire career and at a bank or related entity for the last six years, I am and will not claim to be an expert on the intricacies of banking, and specifically events that lead to receiverships; much of what I share below is what I have read or heard from others. I know more than the average person, which simply means that I know enough to be dangerous.

The primary reason I am writing this today is (1) to share what I believe to be true to my family and close friends, who graciously read my writing semi-consistently; and (2) because the last few days are the kind that (you hope) only come around once in a lifetime. And you really hope they never come at all.

We’ll walk through what happened. I will anchor this on facts but will not hesitate to sprinkle in my own commentary. In addition to the usual disclaimer at the bottom of every post I write, I am sharing here, explicitly, that these views are mine and mine alone.

SVB … What Happened?

SVB’s rapid collapse was a textbook bank run. Look up the definition and SVB’s logo should be right next to it.

A bank run is, at its core, a confidence game. Solvency, book value, forecasts — none of that matters once a bank run begins. The moment there is concern, justified or not, and confidence in a bank is lost, reversing course is about as easy as stopping an eighteen-wheeler with a pillow. Just about the only thing that can stop it is a large, immediate infusion of cash or even the appearance of cash. Short of that, curtains.

How did everybody lose confidence in a bank that had been around for 40 years, was the 16th-largest bank in the US, and one that had $200B+ of assets as recently as January … in the span of 36 hours? The below is, to the best of my knowledge, what happened.

Silvergate’s announcement that they were liquidating all assets and shutting down operations after 35 years in business came on the afternoon on Wednesday, March 8th. To those following the crypto industry closely, this was not entirely surprising, but it was shocking. Silvergate had leaned into serving crypto companies in a significant way, and had gotten caught up in the FTX collapse. I’m not sure if you’ve heard, but crypto has had a tough go of it recently. Silvergate fell victim to a slow-but-developing bank run over the last several months. A notable detail I don’t want getting lost: Silvergate chose to voluntarily wind down operations, allowing for an orderly liquidation process for their clients.

Around that same time, SVB announced a sale of its available for sale securities portfolio, one that resulted in a $1.8B loss. In addition to this and in an attempt to shore up its balance sheet, SVB also announced their intention to raise capital by selling its own equity.

The market, having *just heard* about a separate innovation-focused, sector-concentrated bank going under because it didn’t have the assets to match deposits, collectively freaked out. As did some of SVB’s largest depositors.

Thursday saw a massive bank run, to the tune of ~$42B in outflows. By end of day Thursday, SVB was all but out of time. By Friday morning, SVB became the second-largest bank ‘failure’ in US history.

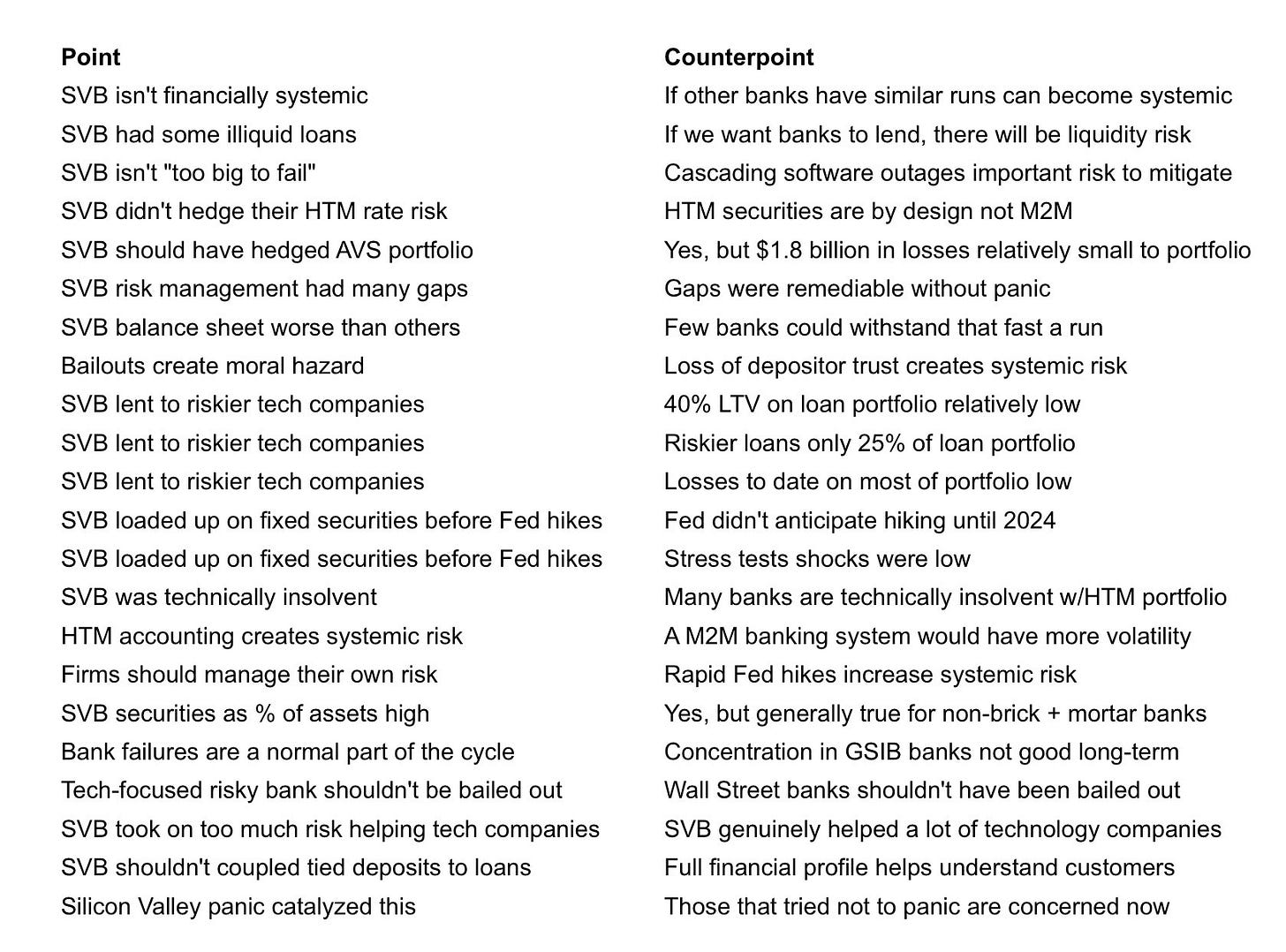

A lot of people have chosen to opine on this situation without working to understand the details, which is an unfortunate but expected result in our current state of social media. I saw this on Twitter and found it to be an immensely valuable resource for navigating the noise.

What Makes This So Bad?

If you’re building in tech, working on a novel therapeutic drug, or helping combat climate change, it is extremely likely that you touch SVB. Even if you don’t bank with SVB, your company probably does. Even if your company doesn’t, their venture capital partners almost assuredly do. And even if none of them bank with SVB, some of their limited partners have exposure, through both their public equity and private markets portfolios. A meaningful hit to any of those layers slows the capital carousel; a large enough hit to all three closes the park.

There are obvious and less obvious reasons as to why this is so important.

The obvious:

Tens of thousands of startups and small businesses will struggle to make payroll immediately. Without access to their capital, they are *literally* unable to pay their employees. If that lack of access extends long enough — even if just weeks — this may become an extinction-level event. The relative silence from the Fed has been deafening on this point. Y Combinator is but one participant in the ecosystem, and their portfolio touches a quarter-million people.

Per the above, tens of thousands of startups means hundreds of thousands, if not millions, of people relying on those startups to put food on the table. This just became a very big deal to a large number of people, almost all of whom are no better offer off financially than those in other industries.

The other side of the capital coin: most venture capital firms banked with SVB. Without access to their accounts — and importantly, to unique ways of accessing their capital that SVB was especially competent at, eg capital call lines — expect the funding market to dry up considerably for startups. Capital just got tight right when startups likely need it most — remember, the macro economy is in a precarious position — which means many startups that otherwise might have made it through, won’t.

The less obvious:

More than 60 percent of community solar financing nationwide involved Silicon Valley Bank. I hope Senator Elizabeth Warren supporters remember the damage she helped cause to the advancement of renewable energy when she cheered on a bank run (Silvergate) that led to the collapse of the most supportive bank for clean energy innovation.

Many, many others will be impacted by this, even if they don’t yet realize it. SVB was (easily) the largest banker and lender to early-stage medical device and biotech companies. Scoff all you want at the importance of WhatsApp, Instagram, Tik Tok, Uber, Airbnb, DoorDash, Instacart, and Substack (as you read this), but there are life-saving drugs, medicines, and machinery being created today that may not live to see tomorrow. We might not feel that immediately, but the impact will show up in the future.

Pension systems, public university endowments, and non-profit foundations are all hit by this as well. Most institutional portfolios hold anywhere from 3-15% of their value in venture capital funds. Some hold even more. Any significant destruction of value to startups will have second- and third-order effects on firefighter pension plans, public university scholarships, non-profit grant programs, and more. This isn’t a ‘tech bros’ issue, this is a wide-reaching economic one.

In short, the collapse of SVB is important for one simple reason: it was the cornerstone for innovation in the US (and increasingly around the world) and without it, there are no plug-and-play replacements for the comprehensive suite of unique products they offered to further that innovation.

Okay, So How Did This Happen?

Some bad investments, worse timing, poor communication, fear-induced mania, and downright irresponsible policy guidance from the Fed.

Bad Investments

To start, SVB is not blameless — they purchased too many low interest, long-term investments just before (and while) interest rates began to rise. These investment decisions coincided with a weakening capital market which, specific to their startup-focused business model, meant that companies would be drawing down their cash balances. The rationale for buying these assets in particular will be covered in detail shortly.

Worse Timing

With that said, the damage done from those investments was recoverable. The decision to sell Fed Treasuries at a (big) loss in the first place was to limit the damage they could do by holding them for longer; SVB recognized that those positions could get even worse, so the best approach is to cut your losses before they kneecap you. Good luck finding other banks doing that after this; we are more likely going to hear of many who held these positions far longer, taking on larger (by percentage) losses than SVB.

The decision to sell stock as part of an equity raise was done to shore up the bank’s cash position considering a cyclical, well-known phenomenon: fresh deposits were decelerating faster than underlying client cash burn rates. This comes with the territory of serving startups, and while not inconsequential, also not something that is unusual (in scope, if not in size).

With Silvergate shutting down, bank run fears within the tech sector were naturally top of mind. Because SVB informed the market of both of these things within hours of Silvergate’s announcements, SVB was pulled into that vortex. If SVB makes these announcements two weeks earlier or two weeks later, we might avoid this altogether.

Poor Communication

Then, a morning call with venture capital depositors, who also indirectly act as decision-makers for where portfolio companies bank, wasn’t worded perfectly. We can Monday Morning Quarterback this and say that call should have gone better, but people are human and it didn’t. The TL;DR is that SVB shared that they would be fine, so long as nobody panicked.

A couple of firms, firms that SVB has served for decades and through the worst of times, panicked. The irony of these firms being the ones that ‘take risk’ on entrepreneurs should be lost on nobody. None of these firms thought too hard about the second-order ramifications of what might happen to SVB — the foundation helping enable much of the success they have enjoyed — should their largest clients abandon them. Their urge to ‘add value’ to portfolio companies kicked in and there was your starting pistol. Off to the races.

Fear-Induced Mania

With SVB’s shares trading down 30%+ after-hours on Wednesday and the fateful call between SVB and its largest VC depositors in the books, Thursday was primed for chaos.

Those several venture capital firms that played an explicit and vocal role (privately) in pushing portfolio companies to withdraw assets from SVB triggered an industry-wide, fear-induced mania. Everybody in tech talks to everybody else and tweets constantly. Within hours, questioning SVB’s ‘solvency’ became the topic du jour. At a certain point, if you weren’t telling other people to freak out, it felt like you were doing them a disservice. Freaking out was ‘the right thing to do’; staying calm became contrarian.

Simply put, not enough people — and importantly, not enough of the right people — expressed calm in the hours during which it was most needed. SVB supported founders and investors with empathy and capital on their worst days, and when SVB needed their support, it was nearly nonexistent.

And that’s how more than $40B is pulled out of an operationally-sufficient, solvent bank in a single day.

You can count on one hand, and possibly need only several fingers, the number of banks that can withstand that kind of outflow in a single day. Almost every bank that is solvent today would be insolvent tomorrow if they faced a similar run.

(I won’t name the firms that allegedly kicked off the mania, other than to say that several of them were late signers to this list of 125+ venture capital firms that have pledged support for a newly-formed version of SVB. Nothing says class like inducing panic that brings down a trusted, foundational institution and then signing up to support them post-collapse. Even classier when those directions to portfolio companies to move away from SVB included the ‘suggestion’ that they move specifically to neobank portfolio companies of their own. I have nothing against those neobanks, many of which are trying to create better banking experiences for all of us. But some of the actions that led to companies being pushed their way were extremely disappointing.)

Irresponsible Policy Guidance from the Fed

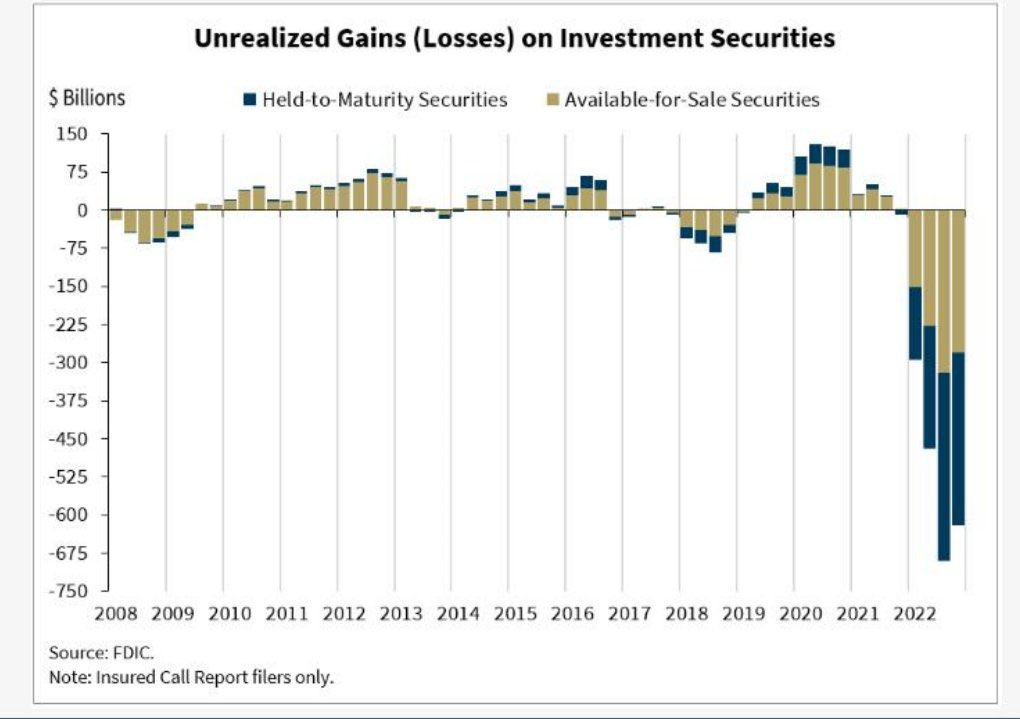

To be crystal clear on the ‘bad’ investments that SVB made: most other banks have unrealized losses, similar in nature to SVB’s, because they, like SVB, trusted the Fed’s guidance and purchased US Treasuries, what is marketed as the safest financial instrument you can buy.

The Fed devalued those assets with explosive rate hikes, and here we are: SVB gone while $600B+ in Fed-caused unrealized losses sit across the banking sector. Other banks won’t face SVB’s fate unless a similar bank run is pushed onto them, forcing them to realize those losses and bring into question their solvency. (First Republic Bank, one of SVB’s long-time competitors and another ardent supporter of the innovation economy, may be bracing for this exact scenario come Monday morning, should a proactive message of confidence in the banking sector not come from the Fed.)

There is a lot of energy being aimed at ‘not bailing out’ SVB. Where it should be directed is at the Fed, because of the above and because nobody is asking to bail out SVB’s equity holders or executive team — they’re asking to make depositors whole. The fact that so many seem to think that the tech ecosystem is asking for a bailout only increases the concern we see a bank run at other banks on Monday.

If we’re going to ignore the past 70 years of precedent — during which time every major bank failure has seen the government make depositors whole or almost entirely whole, even above the FDIC insurance ‘limit’ of $250K — then you might as well skip a few steps and shut down every small and/or regional bank today. None will survive the month if and as a bank run on most of the financial system kicks off, pushing all assets into the largest 4-5 banks. And what we all want in life is for JP Morgan, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs to sit unchallenged atop a financial oligopoly.

Side note: do not get me started on why the government insures $2.5M of assets spread across 10 banks but only $250K of that same $2.5M if it is all kept at one bank. I know why that is, which only makes it even more important for this country to have an honest, real, much longer conversation about the fractional reserve banking system that exists today. Which leads us to …

A Very Quick Bitcoin Insert

I do not say this flippantly given the circumstances, but this is *precisely* why Bitcoin exists: Bitcoin was created in direct response to the only other US bank failure larger than SVB.

There can be no bank run on a fully-transparent monetary network on which ‘double-spending’ assets is programmatically impossible. The fractional reserve banking system is fundamentally broken. That isn’t to say it isn’t useful — our entire economy exists on top of it — but it will not stand the test of time. It could be years or decades until that moment comes, but we can be sure that there is an expiration date attached to it.

If you’re worried about *any* fiat banking institution, at any time, cold storage Bitcoin looks pretty attractive. If the 16th-largest bank in the US can fall in hours, despite a collapse that was entirely avoidable, it stands to reason that Bitcoin pulls in some new converts from this.

Okay, I laughed at this. Just for a moment.

What Happens Next?

Either catastrophe for the innovation ecosystem, which would mean a long, dark period for this country’s growth engine, or a significant, painful setback but one that allows for recovery.

The catastrophic outcome is quite simple: if the Fed continues to slow-play its support for SVB depositors, small businesses will die, livelihoods will be lost, and other banks will be subject to what SVB just faced as soon as Monday morning. Had the government stepped in on Friday to guarantee support for SVB’s depositors, SVB could have been preserved, albeit likely under a new owner. This approach would have minimized the risk of any government losses. Instead, the inaction from the government has almost certainly created more systemic risk.

While it is true that Treasury Secretary Janet Yellen shared the following …

“Americans need to feel confident that the banking system is safe and sound such that it can meet the credit needs of households and businesses, and that depositors don’t have to worry about losing access to their money.”

… it is clear that the Fed wants to avoid the two most toxic words in banking — bail out — and as such is approaching the messaging of any backstop with extreme caution.

To make this overwhelmingly clear, again: nobody in Silicon Valley is asking for a bail out of SVB. Everybody is asking for depositor relief to not only save the growth engine of this country but mitigate the risk of igniting bank runs at other institutions.

That sounds like fear-mongering, and I hope that’s what it ends up being in a week, in a year, in a decade — because that will mean the worst case scenario was averted. If left unfettered, this will have immediate and long term ramifications on the ‘real’ economy.

Conversely, the sooner the Fed makes it clear that there is a plan for depositors, the sooner the sentiment around this entire ordeal can reverse course. The FDIC has kicked off an auction process for SVB, with final bids due this afternoon. There is optimism that a deal will come together.

The expectation, as I currently understand it, is that FDIC insurance (up to $250K) will kick in for SVB depositors come Monday morning. Following that, some amount of the uninsured capital — ~97% of deposits on SVB were uninsured, ie, they were deposits in excess of $250K — will be made available via an ‘advance’ from the FDIC as SVB manages the sale of its existing assets.

There is no scenario whereby the tech industry is better today than it was three days ago. It’s laughable to believe that major banks will step in to fill the newly-created void in venture financing. Venture debt, revolver lines, capital call lines … good luck getting that from [name your favorite big bank]. The insight gained from serving startups and their founders for 40 years is not something that is transferrable in a weekend; certain types of financing products that startups, venture capital firms, and individuals in the ecosystem have become used to will dry up or cease to exist completely, at least in the intermediate.

Sometimes corporate slogans are half-truths or far-fetched aspirations. SVB was the opposite. ‘The bank for the innovation economy’ was just that. Many of those who helped promote SVB’s downfall or cheered it on from the sidelines will find out just how difficult it will be to build a company, raise capital, and weather the inevitable storms that hit innovative pursuits without the most-trusted and well-suited banking partner for those endeavors.

I genuinely wish all of those the best of luck, because they are going to need it. And I really, honestly hope they succeed in their pursuits.

Because the world is better when innovation flourishes. That, and cheering all innovators on, is what being an SVBer will always be about.

[Disclaimer: Any opinions expressed are solely my own and do not express the views or opinions of my employer. Because the information included in this newsletter is based on my personal opinion and experience, it should not be considered professional financial analysis or advice.]