3.2.24

Bitcoin ETFs are breaking records, Coinbase approaches a monumental legal victory, and the dog still has a hat

Almost exactly one year ago, SVB collapsed and the world of tech and regional banking was thrown into a new paradigm in the span of a weekend. Crypto was painted as the scapegoat and identified as public enemy number one, the toxic waste that destroyed SVB, Silvergate, and Signature.

Today, we have Bitcoin spot ETFs, memecoins stuck on up-only, and real crypto products being used by real people.

Stop fading the thing that has repeatedly shown you its will to survive is stronger than your belief it will fail. Lesson in there.

The King is Here, and He Never Left

It is Bitcoin’s world and we’re lucky to be living in it. Unironically, each and every single one of us should feel #blessed to experience the birth of Bitcoin and its evolution into a legitimate, institutionally-stamped asset, bringing the rest of the crypto ecosystem along with it.

There is sexier innovation happening in crypto that will make the internet and the world a better place. But Bitcoin remains a certified centerfold, the sun to our maturing ecosystem, the oxygen to this flame that can’t be put out.

All of a sudden, Bitcoin is rapidly approaching its all-time high of ~$69K. Bitcoin was ~$20K on March 3, 2023. It just printed a ~$20K monthly candle in February. New all-time high incoming (very) shortly.

There were people — maybe the majority of people — telling you to sell the news leading up to and through the ETF approval decision. As I said in the moment, these are not serious people. Mute them, block them, redeem your capital from them. They don’t understand capital markets, they don’t understand the asset allocation industry, they don’t understand math, and they definitely don’t understand Bitcoin.

Vanguard’s CEO, Tim Buckley, announced this past week that he is stepping down after six years at the helm of the second-largest asset manager in the world. This guy thought he was above Bitcoin and played gatekeeper at the expense of his clients. You come at the king, you best not miss. (No, I do not care if his departure is related to Bitcoin or not.) Vanguard will capitulate by the end of the year, and almost certainly much sooner.

JPMorgan just published a report that says that ‘once bitcoin-halving-induced euphoria subsides after April’ the price of bitcoin will bleed down to ~$42K. There are potentially three things going on here: (1) JPMorgan analysts don’t understand what the ‘halving’ actually does; (2) JPMorgan analysts are purposefully trying to depress the price so that the firm can find a better entry point for their CEO’s capitulation; and/or (3) they are somehow not aware of the fact that spot Bitcoin ETFs are breaking records left and right, despite their firm being named as an Authorized Participant for the largest Bitcoin ETF in all of the land. It’s at least one of those, and probably all three.

I’ll continue to scream this into the ether: there are trillions of dollars in the capital markets that have never had the approval nor the reputation protection to buy Bitcoin. BlackRock, Fidelity, and others just provided both of those things. And many of these capital sources don’t touch asset classes that carry market caps in the billions. These people start buying only when the Big T makes an appearance. And would you look at that: Bitcoin just crossed $1T in market capitalization.

So let’s get into what has happened …

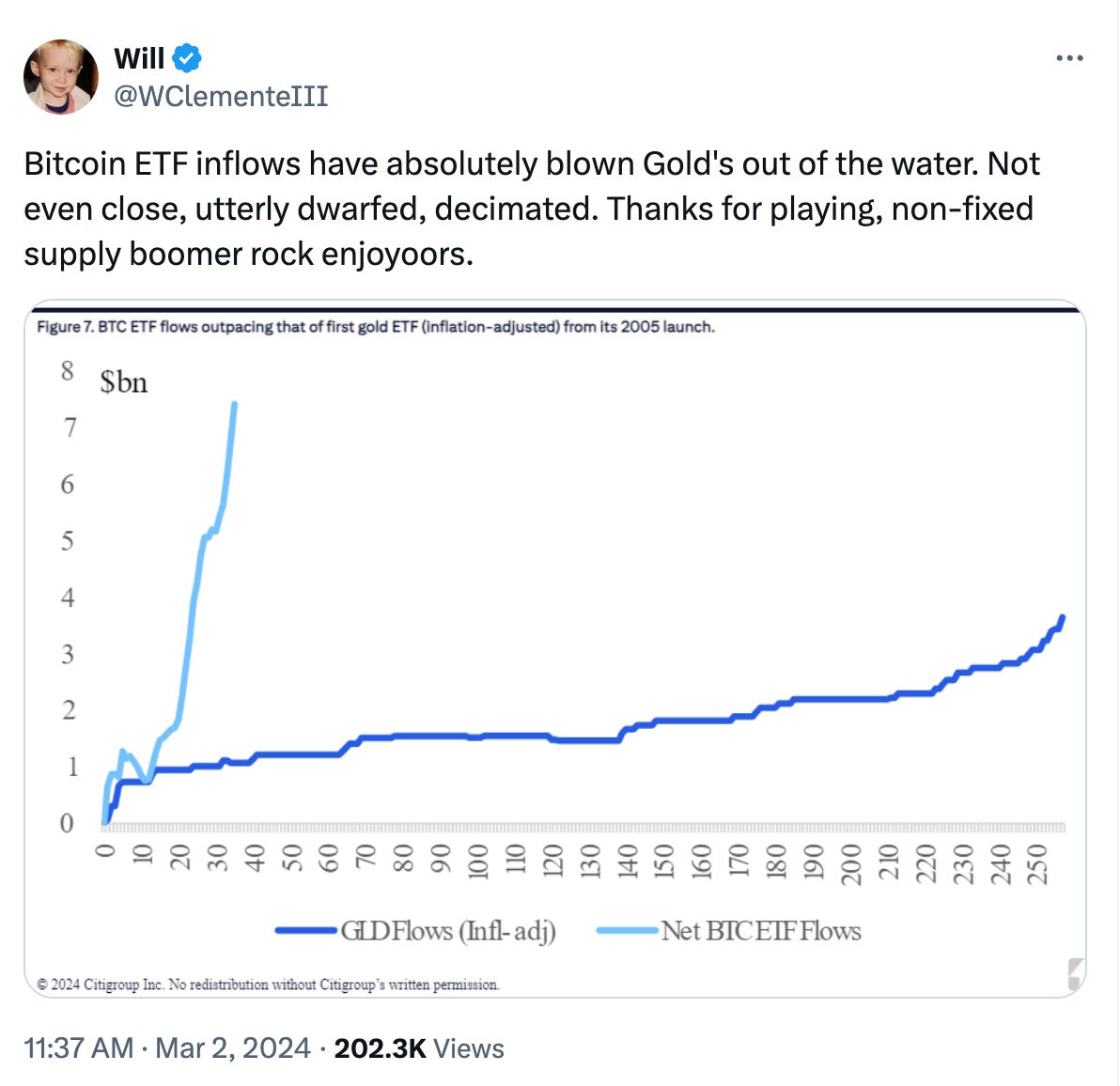

Bitcoin spot ETFs just delivered a record-breaking week of volume, including $7.6B+ on Wednesday alone and $22B for the week. iShares Bitcoin Trust ($IBIT), BlackRock’s spot Bitcoin ETF, crossed $10B in AUM by end of day Friday. Eleven digits in seven weeks is absurd, and IBIT is easily the fastest to reach that milestone.

It took the fastest-growing gold ETF (SPDR Gold Shares, $GLD) — the most successful ETF launch of this generation — nearly three years to reach $10B in AUM. There are levels to this.

Even when accounting for inflation, Bitcoin has outperformed gold ETFs by miles, and lapped it again for good measure. Absolute, relative, inflation-adjusted. It doesn’t matter: Bitcoin is it. The best ETF launch ever. Welcome to the show.

Bitcoin at scale has always been better than gold as a non-sovereign, hard asset, and as the purest form of collateral. The ETF approval just cemented that it would have an opportunity to prove that. And I can’t remind you of this enough: people told you to sell the news.

Total AUM in Bitcoin spot ETFs is up to ~$21B less than two months into this journey. $100B in AUM by end of year feels conservative, considering the onslaught of advertising that is coming for the market, both privately and publicly. And then consider this:

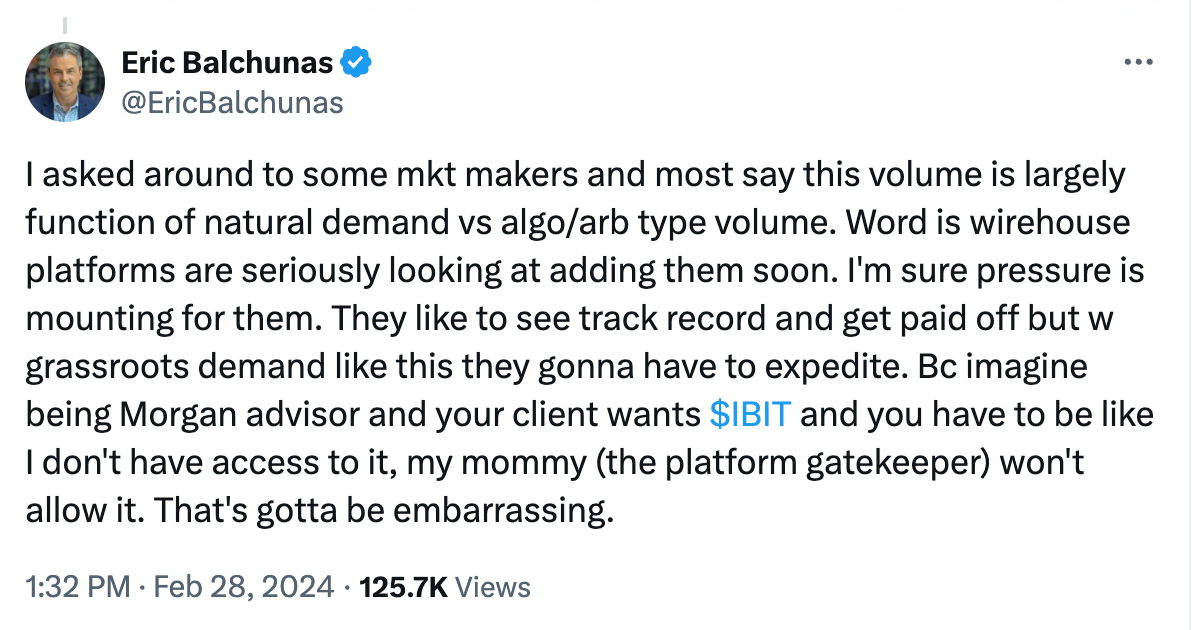

Most of the volume to date has been driven by retail and hedge funds.

RIAs, a group of institutional investors that hold more than $1T in assets, haven’t started buying, as they typically want to see several months of data before diving in.

The world’s largest brokers – think Morgan Stanley, Bank of America, UBS, Merrill Lynch, Wells Fargo – haven’t even added spot Bitcoin ETFs yet, as they typically want to see a track record first. But per the screenshot below, such explosive initial demand (with ~zero marketing) has them reconsidering how long they can wait. Morgan Stanley’s advisors alone have something in the neighborhood of $4T in assets.

Several weeks ago, Fidelity came out and shared that they are recommending a 1-3% allocation for Bitcoin in client portfolios. Your momma’s 60-40 portfolio allocation just became 59-39-2. Welcome to the new world order.

The cat is out of the bag and there’s no way to get it back in. A 1-3% allocation recommendation is simply a gateway to acceptance. Most money managers are not gamblers; they understand that going against a widely-accepted portfolio recommendation (such as Fidelity’s, potentially) could quickly create client departure risk if their clients miss out on Bitcoin. So the baseline has stepped up from zero to non-zero almost overnight.

Others will look for an edge, and will find only two options at scale: tick up your target allocation to try to outperform the competition or take a stand against the most viral asset in the capital markets. I wonder which one firms will choose. (I don’t actually wonder.)

A couple other fun things:

Maybe Michael Saylor won. MicroStrategy never stopped accumulating bitcoin and now they make $19M+ for every $100 move in the price of bitcoin. Yes, you read that right. MicroStrategy is now $6B in profit on their bitcoin purchases. This and the news that Reddit’s IPO filing showed that they hold BTC/ETH in their treasury has the corporate treasury narrative all the way back for crypto. Maybe it never should have left.

El Salvador is flexing on every other (fiat) country in the world now that they’re up 40%+ on their bitcoin holdings. The nation-state narrative might have legs again, too.

Bitcoin Ordinals — NFTs on Bitcoin — are exploding in volume and activity. Early buyers of bitcoin have been sitting on their corn for years without much to do, other than watch their net worth rise and fall and rise some more. Now there is something they can do with their bitcoin, and sheeeesh are they doing it. Puppets are the Pudgy Penguins of Bitcoin: cute, fun, and pure of heart. And the art is exquisite.

Marathon, one of the largest publicly-traded bitcoin mining companies in the world, announced plans to launch their own Bitcoin L2, a blockchain to enable cheaper, faster transactions on top of and that settles to the Bitcoin network. The streets are saying Bitcoin L2s will see explosive growth this year, from a basis of effectively zero a month ago (excluding Stacks, which has been building their Bitcoin L2 for years, and who now sits as a visionary in that respect).

… and what will continue to happen

Okay, we get it. Bitcoin is cool again. What else?

Imagine you and your infant and ten other people with their infants are stranded in a snowstorm. You are all outside a one-room hotel, the only shelter for 100 miles. The room is up for sale, for one person and their infant, at whatever the highest the bidder is willing to pay. What would you pay for that room?

That is what is happening to the supply and demand dynamics for Bitcoin right now, except Bitcoin doesn’t hurt babies. We have never seen inflows of this size come into Bitcoin, nor have we seen such an immediate structural shift in the long-term-oriented buying pressure for it.

Bitcoin spot ETFs already hold ~4% of Bitcoin’s supply. FOUR PERCENT. We are less than two months into this. Do you realize how nuts that is?

There simply isn’t enough bitcoin to go around at current market prices if the infinite institutional bid for bitcoin is here to stay. And all indications are not only that that is the case, but that this is just the beginning.

[To be clear, ‘infinite’ does not mean literally ‘infinite’ in this context; rather, it alludes to the fact that if bitcoin receives entry into widely-accepted asset allocation models from trillion-dollar asset managers, there will always be a bid to buy bitcoin. Very similar to how there is always a bid for public stocks.]

You’re supposed to caveat that a section like the above isn’t financial advice. So I implore you to please come to your own conclusion about an asset that has a very real and documented finite supply and is now seeing so much structural demand that supply can’t keep up. And that this is happening less than two months after an era-defining market shift that kicked this off, before anybody begins marketing this publicly. Study that.

Importantly: do you think Larry Fink and Abby Johnson are seeing this kind of immediate, record-breaking volume for their new pet projects and thinking, “Hmm, let’s keep this on the back-burner with clients. Doesn’t seem like they need it.”

No, that would be insanity. It would be sociopathic to believe that.

Marketing dollars are inefficient and expensive you say? Maybe for your 12-person regurgitation of an enterprise SaaS AI data warehouse startup. But I’m confident the marketing teams for BlackRock, Fidelity, Franklin Templeton, and others are being given blank-check budgets and one goal: more assets. They won’t care about customer acquisition efficiency. You think these people care about LTV/CAC ratios? They want assets under management, as many as they can grab, as fast as they can grab them.

It’s math, and not the hard kind. No need to let geometry and algebra through that door. All you need is arithmetic and arthritis from hitting the buy button too much.

Call this newsletter post euphoric. It might be. I do not care. If you’re against unbridled happiness, seek therapy and find euphoria. Let life be fun when it’s fun. It’s better for your health.

Ethereum ETF Incoming?

The Ethereum ETF decision was delayed but it’s getting more plausible to expect that approval to come sometime in 2024. I previously said I’d take the over on 2024 being the year an Ethereum ETF gets approved, and part of me still clings to the feeling that its path to institutional adoption will face more resistance than Bitcoin’s.

But if Larry Fink is going to go on TV and talk about tokenizing everything — on the back of filing for an Ethereum ETF — my priors need revising. BlackRock has still only ever been denied one time at the ETF altar. The next date to circle on your calendars for an actionable update is May 23, 2024.

If we do get an Ethereum ETF, that likely opens the floodgates for other crypto ETFs in short order. Dream bigger.

Coinbase v. The SEC

One developing story that the crypto industry is hyper aware of but that the broader markets don’t yet fully appreciate is that Coinbase’s case is likely to get dismissed, and Coinbase may already know this. This result would put a high-profile legal win behind the argument that crypto assets are not securities. Seems important, and seems very good. Reading the tea leaves …

A cryptic tweet from Coinbase’s chief legal officer in early February suggested that a company’s external counsel shouldn’t front-run internal counsel on the announcement of a big legal win. I wonder what big legal win their team might want to control the narrative on?

Uniswap Foundation, the team behind Uniswap, one of the leading decentralized exchanges, has had ample opportunity to use their token to capture fees from their platform. They have been hesitant to do that for nearly four years despite the obvious value it can generate for the UNI token, largely due to ‘legal uncertainty.’ Then two weeks ago, the foundation itself proposed an upgrade to the protocol so that its fee mechanisms would reward UNI token holders. Uniswap is backed by a16z, who is an investor in Coinbase. You can connect the dots.

If (and hopefully when) this is announced, we ride for Coinbase. Thank You Base God. And if we get this result, you can expect tokenless protocols to flood the market with tokens as the argument that tokens are securities will have been weakened substantially (at least for now).

The regulatory environment in the US isn’t close to being solved, but legal wins like this create (or avoid) precedent, and it’s always good to have precedent on your side.

The Hat Stays On, and a Word About Memecoins

dogwifhat ($WIF) has blossomed into the memecoin of this cycle so far and the cutest dog in crypto. It has also ripped through $1, becoming the first dog coin to hit $1/token and delivering a ~16,000% return in the last three months. I mean look at it. It has a hat.

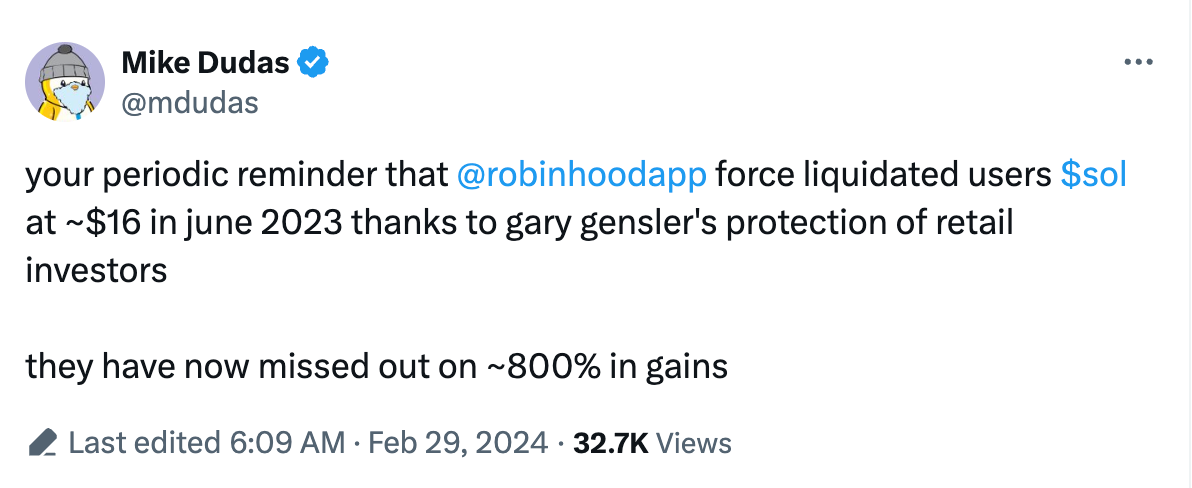

The recent surge and milestone breakthrough was driven by Robinhood listing WIF on their EU platform. That’s right, Robinhood listed a token because the dog has a hat. (This is, of course, the same company that forced all of its customers to liquidate their Solana holdings held on the platform at the bottom of the bear market. I guess they’re trying to make up for it by now allowing those same customers to buy a new memecoin.)

The last month has seen a 15-pound, hand-knit hat top the Wall Street bull, new signage put up suggesting the world’s most famous street has been renamed to WIF Street, and now a major trading platform listing.

The simplest way to think about memecoins is that they represent the financialization of internet memes. So much of the dialogue around these tokens — which have zero utility or ‘fundamental’ value — centers around their, well, lack of value. This is logical! There are no cash flows and no applications built on top of them. They exist and have value simply because a community of people want them to.

But memes have never been easily and structurally monetizable, despite the fact that people have been posting memes online for two or three decades. Maybe memes have always had value, but that value couldn’t be captured previously, at least in a coordinated way.

There is also the not-insignificant purpose that memecoins serve a society that is chronically online: easy, permissionless gambling. I know gambling is a dirty word but go look at how much money is dumped into lottery tickets ($300B+ in 2023), casinos ($200B+), and daily fantasy sports ($25B+). Gambling exists, and betting on the next meme to go viral seems like a very short leap for the Tik Tok generation to make, even if it does feel uncomfortably dystopian and pulled directly from a Black Mirror episode.

This isn’t a moral judgment on gambling or memecoins. The dog has a hat, the dog has always had a hat, and I laugh every time I see the photo. And now one of the more influential fintech companies of this generation sees value in letting its customers participate in whatever it is.

A Very Brief FTX and Gemini Earn Update

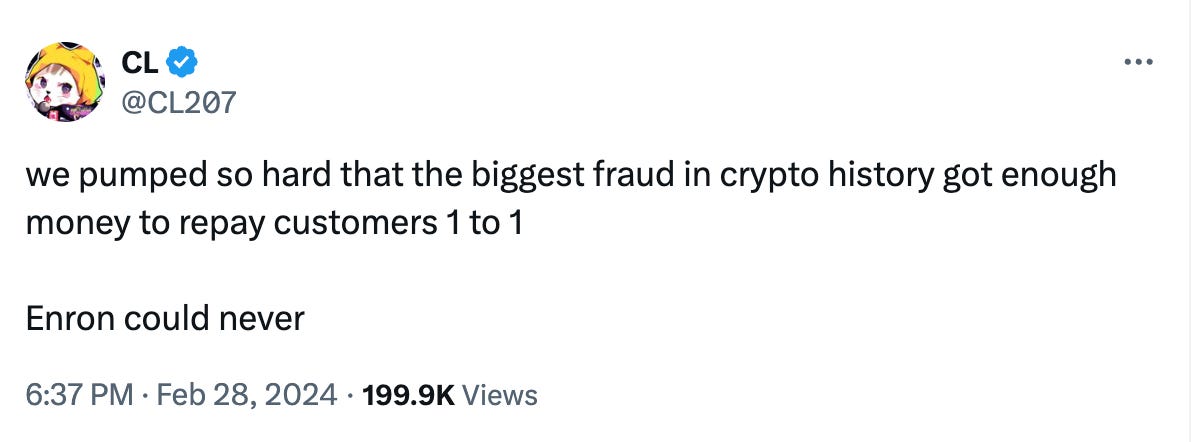

Only in crypto can firms torch tens of billions of customer deposits and those customers make it back — in kind! — simply because of price appreciation. Some might say that we take care of our own.

More Happenings

Speaking of Coinbase, the Coinbase App Store ranking is starting to go parabolic, suggesting that retail is (finally) coming back to crypto. From #422 to #128 in the span of four days. This typically happens as Bitcoin approaches and surpasses its all-time high, so we’re right on schedule. Let’s just please limit the leverage. In the name of all things holy. Please.

Circle filed for an IPO. Getting Circle into the public markets would be another sign of validation for the crypto ecosystem and would cast a spotlight on the massive growth in adoption and importance of stablecoins in the capital markets. Semi-relatedly, there is some movement from legislators to prioritize USDC as the stablecoin of choice, rather than trying to push a centralized, private CBDC. For better or worse, lawmakers seem to be waking up to the fact that publicly-verifiable stablecoins provide them with more transparency into how money is spent, transferred, and held, both in the US and around the world. Stables aren’t just for horses anymore.

If you’re looking for the ‘front page of crypto’, I direct you to Farcaster. It’s the first crypto-native social experience that feels fun and sustainable.

Fundings You Should Care About

EigenLayer raised $100M in a financing led by a16z Crypto. EigenLayer is a restaking protocol built on top of Ethereum that already has $10B worth of Ethereum staked to its platform.

Backpack raised $17M to continue building out their crypto exchange and self-custodial wallet. Backpack seems well-positioned to help fill the gap left by FTX, in part because of the company’s perseverance: their previous round was led by FTX and almost entirely lost in its collapse, pushing Backpack’s founders to launch an innovative NFT project (Mad Lads) to raise funds and survive. Mad Lads is now the largest NFT project by market cap on Solana.

[Disclaimer: Any opinions expressed are solely my own and do not express the views or opinions of my employer. Because the information included in this newsletter is based on my personal opinion and experience, it should not be considered professional financial analysis or advice.]

Love this and miss you brother!

another informative and entertaining update on all things crypto that also isn't investment advice!