3.5.23

Coinbase delivers, Bitcoin is cool again, OpenSea vs. Blur, Silvergate goes down, real assets are getting tokenized, and NFTs continue to grow in relevance

A lot has happened in the last couple of weeks so here is today’s fixed menu:

Coinbase announces an L2, completes their return to being crypto’s innovative leader

Let’s get bullish on (building on) Bitcoin again

OpenSea vs. Blur and some loosely-held thoughts on creator royalties

Silvergate has big, big problems

SBF is collecting white collar crimes like my son collects rocks in the backyard while his friends go snitching

The SEC hires a bunch of enforcers, regulatory guidance remains optional

🔵 Coinbase Drops the Base

Coinbase cares not for your bear market vibes and intense regulatory scrutiny.

Crypto’s publicly-traded leader announced the launch of their own Layer 2 (‘L2’) blockchain, Base, delivering a watershed moment for both the industry and Ethereum’s scaling ecosystem.

Some context, then some analysis on why this is so important.

What is an L2? How will Base work?

Very quickly: The base layer of a blockchain is considered its Layer 1 (‘L1’). Think Bitcoin, Ethereum, Solana. L2 networks act as scaling solutions to reduce network congestion and allow for (much) greater transaction throughput to their native L1s.

To oversimplify, L2s batch a lot of transactions together and publish those batches to their respective L1, turning what would have been 100s or 1,000s of transactions in need of validation into a single transaction. They do this while cutting transaction fees significantly (from $1s or $10s to pennies) and creating space for more utility (lower fees means expansive use cases and the ability to prioritize user experience). Coindesk has a solid overview here.

Base is an L2 built using Optimism’s OP Stack, which uses ‘optimistic rollups’ to sit in parallel to the main Ethereum chain, run all its transactions, and then post the data from those transaction back to its L1 (in this case, Ethereum). With that said, Base will not limit itself to Ethereum, and will provide easy and secure access to other blockchain ecosystems like Solana, Polygon, and Avalanche.

Importantly, Coinbase was very clear that there are no plans to issue a new network token for Base. This is unsurprising given the regulatory landscape — The Genz would have a field day with this, no doubt — but it also (maybe?) marks a shift in how value capture is viewed: rather than fragmenting value by launching a brand new token, Coinbase is instead opting to help concentrate that value to a core set of protocols, eg Ethereum, by creating value that accrues to their ecosystems.

There is still a non-zero chance Coinbase eventually launches a token, but that seems like regulatory suicide for a company whose biggest moat just might be its (relative) regulatory compliance.

Why Does This Matter?

A secure, low-cost, developer-friendly way for anyone, anywhere, to build decentralized applications on-chain.

Upon the launch of Base, Coinbase will immediately allow developers to directly integrate their product with the protocol, providing crucial fiat on-ramps to any decentralized application that does. That means 110M verified users and $80B of assets in the Coinbase ecosystem will soon have direct access to any decentralized application. That is probably nothing fucking something.

This will supercharge L2 infrastructure, tooling, and development; it will drive up demand for Ethereum blockspace; and it will incentivize Coinbase to focus efforts on furthering public goods infrastructure, initially on Ethereum but ideally across blockchain ecosystems.

Coinbase is the first publicly-traded company to build an L2 solution on Ethereum.

Coinbase isn’t doing this out of the goodness of their heart. Yes, Base was developed to help further the industry and expand access to decentralized networks to all users. But it’s also going to print money for Coinbase.

Transaction fees on a scaling solution such as an L2 are small on an individual basis but add up quickly considering how fast and easy L2s are to use. For rollup scaling solutions like Base, transaction fees go to the sequencer. Sequencers are responsible for processing transactions, rolling up the transactions into a block, and then submitting those blocks of transactions to the L1 network. In this case, Coinbase is the sequencer.

I like to write and I like numbers; if I had any knowledge of the sciences, ability with the arts, and knew what the password to my Peloton account was, I’d be a Renaissance man. So let’s look at some numbers.

BSC, the L1 developed and maintained by Binance, rakes in ~$1M in fees most days. Arbitrum, an optimistic rollup competitor of Optimism, sees similar transaction value volume, so they are probably pulling in something similar. Assuming Base can pull in similar adoption, Coinbase just launched a product that could generate at least $300-400M+ every year. You start onboarding some net new users and get a bull market cooking and those M’s start looking like B’s.

(To get ahead of the follow-up question: while Coinbase will be the only sequencer for Base transactions today, the vision is for Base to eventually have a fully permissionless validator set. You love to see it.)

Wall Street, of course, did not care: Coinbase’s stock has traded roughly flat since the announcement. The efficient market hypothesis is taking an early spring break.

Nobody is better positioned than Coinbase to onboard tens, if not hundreds, of millions of net new users and institutions on-chain.

This is, simply, a win for everybody. Easier on-ramps, better products, more users. Crypto is the winner here.

For those wondering if this can work, Binance has already executed a similar strategy, cultural and regulatory environment differences aside. Within months of launching, Binance’s BSC network became one of the largest blockchain ecosystems in the industry by using its massive exchange business as its top of funnel and its warchest of capital to fund new projects building on BSC.

Coinbase can take a similar approach, with several distinct differences: it has aligned itself with the ethos of the industry by building on top of existing, proven decentralized infrastructure rather than building its own quasi-centralized ledger; and it brings the aura of accountability, the vibe of validity to accessing decentralized applications in a crypto-native way.

They are building open-source tech that can be used in a permissionless way and easily constructed for use in compliant sandboxes, depending on the end user’s goals.

And the lack of a token might seem like an inhibitor to incentivizing Base’s adoption but …

While the US government tries to choke away its reserve currency and stablecoin dominance to the rest of the world, Base sits in a position to save the US Dollar and its henchmen from themselves.

When I said that Coinbase wasn’t doing this for purely altruistic reasons (effective altruism PTSD alert), this is the other reason why.

Because Coinbase is the only sequencer for the Base protocol initially, they and they alone determine what price users pay for transactions. This also allows them to manage the fees that they earn after settling these transactions on Ethereum. Rollup sequencers profit by charging slightly more in gas fees than the required settlement costs.

But Coinbase doesn’t have to profit on all transactions; if they wanted to, they can make all USDC transactions on Base free. The same USDC that Coinbase and Circle print money on, and will continue to as long as rates sit above zero.

Coinbase would immediately become a frenemy to Visa and MasterCard. I’m not sure if you’re aware, but a permissionless, borderless, near-instantaneous, and free payments network is the holy grail for money movement. Massive amounts of liquidity, developers, and applications would migrate to Base, and USDC would solidify itself as the de facto digital reserve currency of the world (at least until the US Dollar eventually succumbs to old age, corruption, and devaluation, in which case we turn to the King, Bitcoin). Don’t mind crypto, it’s just saving the US government’s geopolitical standing despite no sign of similar reciprocity.

(Free competitor analysis: Visa and MasterCard settled nearly $22T in transaction volume between themselves in 2022. But they can only charge a fee when a user transacts, whereas Coinbase can earn both on the transaction and while that USDC sits idly in user wallets, per the interest it collects.)

Coinbase’s efforts with Base will bleed into all corners of crypto — DeFi, gaming, social networks — and eventually into ‘real-world’ areas as well. We ride.

Institutional DeFi is coming.

Base is a fully open-sourced network, so you don’t need to go through Coinbase to use it. But any user that chooses to use Coinbase as their on-ramp into the on-chain world will need to pass KYC checks with Coinbase.

Because of this, Base becomes ground zero for the ‘permissioned DeFi’ layer for which many institutions have been waiting. Permissionless blockchain networks can be used by anyone, and it is unequivocally important that they remain that way at the base layer. But for institutions that need to comply with KYC, KYB, and AML standards, accessing decentralized applications in a regulatory-compliant way is often non-negotiable; it is why even the crypto-curious institutions have largely dabbled on the fringes of crypto (read: centralized intermediaries).

As a representative example of why this is the case: institutions (and their compliance teams) often struggle with how they can use Uniswap. The permissionless peer-to-peer nature of its protocol means that anyone can be your counterparty for a given trade. This is problematic if the person on the other end, even if unknown to you, is located in a sanctioned country, sits in a politically-exposed position, or is otherwise situated in a way that trips your government’s compliance standards. Argue all you want about government overreach, but if a rule like that exists and is known, your legal team isn’t going to support using decentralized applications and risk significant financial penalties just because it makes you feel cool again.

Enter, permissioned DeFi.

Coinbase is uniquely positioned to build a gated pool of services on top of Base to serve their institutional clientele. While the Base protocol will remain open-source and accessible to all, institutions (and KYC’d individuals) can be granted a playground on which they can benefit from the efficiencies enabled by blockchain technology (24/7 access, global partners, near-instantaneous settlement, etc.) but in an environment in which their counterparties are guaranteed to be qualified participants.

🟠 Introducing the BOBOB Thesis: The Application Era for Bitcoin is Here

As someone who has waited and waited (and waited and waited) for real applications to come to Bitcoin — Stacks and the Lightning Network, two L2-like solutions built on top of Bitcoin, seem like the only builder ecosystems that have cracked the mainstream’s consciousness — seeing the recent NFT-related innovation drive a massive surge of activity on the network has indescribably exciting. The world’s best monetary asset and network deserve more than to sit in the darkness behind a bunch of 24-word combinations.

And so I introduce the Bullish on Building on Bitcoin Thesis: the application era for Bitcoin is here; it is once again cool to build on Bitcoin.

I will spare the readers a detailed account of why it became uncool to build on Bitcoin these last few years but the TL;DR is this: store of value memes, desire to preserve Bitcoin ‘ideals’, and a recognition that other blockchain ecosystems simply made experimentation easier. In my weaker moments, I fell for some of these narratives. Though it may be difficult to believe, I am not infallible.

Instead, let’s spend our time highlighting several recent developments that explain the newfound excitement.

Ordinals Inscriptions Update

There are now ~300,000 ordinals inscriptions that have been created, almost all of which have originated in the past month. This activity is single-handedly driving user attention, developer interest, and rising network fees to Bitcoin.

Block

Block, the artist formerly known as Square and the company responsible for Cash App, is taking its support for the Bitcoin network to the next level: it will begin deploying part of its Bitcoin holdings onto the Lightning Network, one of the L2 solutions that makes Bitcoin network payments faster and cheaper.

They will allocate some of their 10,000+ bitcoin to the Lightning Network, allowing them to serve as a liquidity provider. The Lightning Network is constructed to facilitate peer-to-peer transaction channels, requiring transactions to travel between liquidity providers to get to their destination as efficiently as possible.

Block will provide liquidity for those looking to route transactions through them, and because Lightning Network liquidity providers are compensated for each transaction that they help route, Block will be paid a small fee for their efforts. That means dollar bills for the company and more efficient transaction routing for Lightning Network users. If and as adoption of the Lightning Network grows, Block’s participation could result in a significant revenue stream for the business.

Yuga Labs

Yuga Labs, the creators of the Bored Ape Yacht Club ecosystem, is back with a new NFT collection, Twelvefold — one that will be inscribed on Bitcoin using the Ordinals protocol. There will be an auction to sell off 300 generative art pieces. Don’t stress fam, I got you with the sneak peek:

The importance of Yuga Labs launching a collection on Bitcoin cannot be overstated. They are the world’s largest issuer of NFT intellectual property, with roughly 30% of global NFT market cap on Ethereum is tied to Yuga Labs. They have eight NFT collections, and every single one has a larger market cap than the combined market cap of inscriptions launched on the Ordinals protocol.

And within three months of the invention of inscriptions and despite the extremely nascent market infrastructure* supporting inscribed ordinals, the king of PFPs is dropping a generative art collection on Bitcoin.

(* To drive this point home: the auction process requires all participants to send bitcoin to an address; if you win, you get your inscription a week later, and if you lose, Yuga pinky-swears it will return your bitcoin. Don’t trust, verify, this is not.)

If you had asked *anyone* in crypto three months ago which blockchain Yuga Labs would launch a project on first, gave them the options of Solana or Bitcoin, and made Solana a -10000 favorite, Vegas would be turning off its lights, closing its doors, and packing up bankers boxes of playing cards.

🧑🎨 OpenSea vs. Blur and Some Words on Creator Royalties

If you have paid any attention to the NFT space the last few weeks, you are probably bullish af on Bitcoin again have surely seen the made-for-TV drama playing out between OpenSea and Blur.

To set the stage for those less familiar: OpenSea is the OG incumbent in NFTs. They were building an NFT marketplace back when daily volumes were measured in two digits, not nine or ten. They were building for a use case — access to NFTs — that didn’t exist … until it did. Several years later, the throne is theirs.

Conversely, Blur entered the scene mere months ago, backed by big players (hello, Paradigm) and with a vision to upend the NFT hierarchy. They created an awesome product and supercharged its standing by promising a token that would be distributed to its users. The token launch came several weeks ago, paying out $1.5M in tokens each to the three largest users. Follow the incentives.

(OpenSea still has not launched a token; given everything going on in the regulatory arena, I don’t think that is set to change soon.)

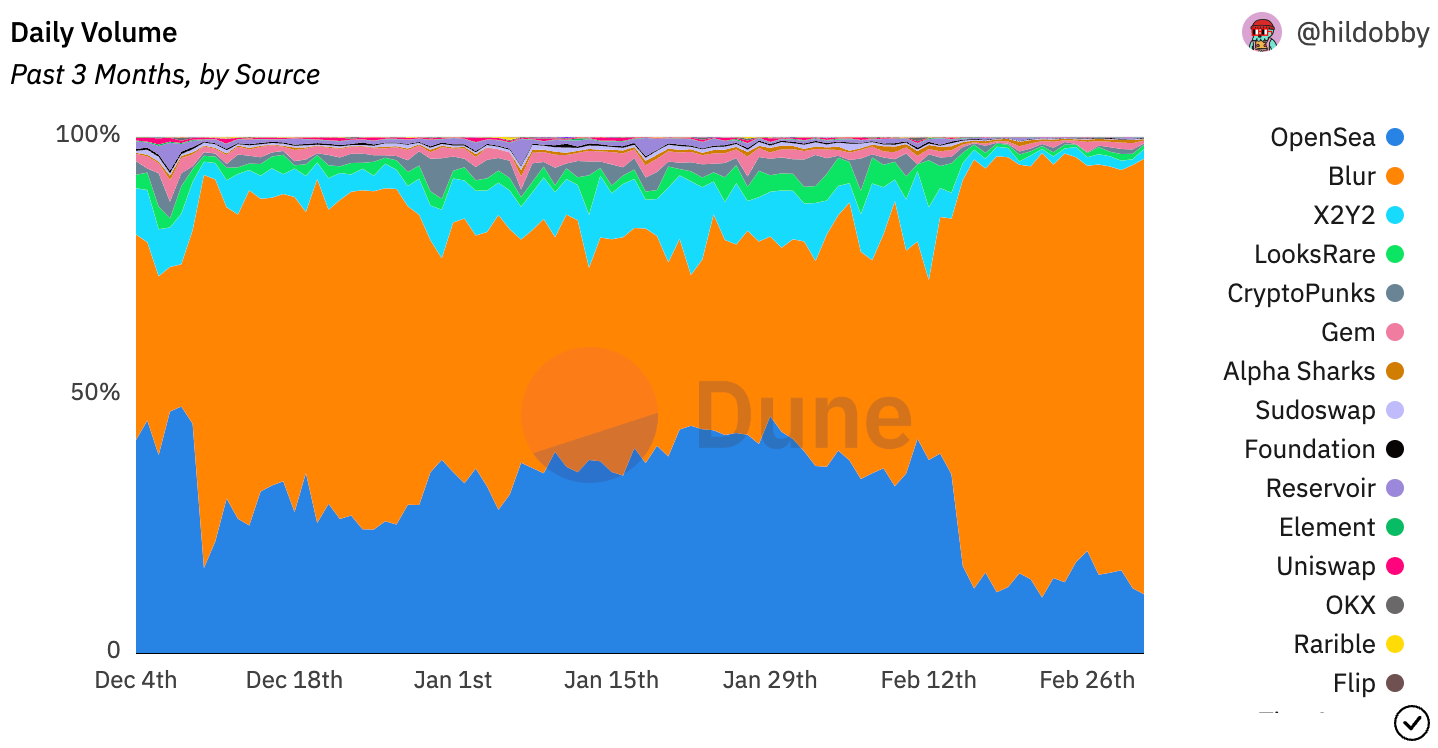

Blur’s growth was also fueled by their decision to do away with royalty enforcement — those buying NFTs on their platform would no longer be required to pay a royalty fee to creators. Including such a fee had historically been the standard, but most newer NFT marketplaces have removed its enforceability to eliminate fee friction for those passing around the non-fungies and eat away at the OG’s market share. Combine token incentives, a legitimately good product experience, and lower fees and you get this result:

OpenSea has long stood tall against the zero-royalty movement, siding with the creators. But Blur somehow Jedi mind-tricked OpenSea into joining Blur and other competitors in making royalty fees optional themselves, accelerating the race to the bottom. Instead of standing on brand and higher ground, OpenSea was sucked into the mud with Blur. Chaos is, indeed, a ladder.

The creator royalty debate is an important one for crypto. Many creators have pointed to immutable ownership and programmatically-enforced royalties as their ‘aha’ moment to try out crypto, NFTs, blockchain, etc. Instead of losing a large percentage of their earnings to middlemen, they are able to showcase and sell their work directly, and share in the upside as that work is re-sold going forward. It’s kind of the main point. Abolishing the enforceability of creator fees full-stop seems like a large step in the direction of building a web2 product with web3’s decidedly shittier user experience.

A middle ground that skews in favor of creators seems most appropriate. A starting point that is admittedly less baked than the popular Ben & Jerry’s flavor: allow creator royalties, but enforce them only when the sale being made is at a higher price (either crypto-nominal or in fiat terms) than it the seller previously acquired it for. This helps ensure that creators won’t capture value in perpetuity for work that is declining in value, but still allows them to participate in the upside of their work. This kind of alignment should push creators to optimize for quality rather than quantity or transactability.

Crypto will lose much of its appeal to creators if they create awesome, valuable work that rewards them in the traditional way: upfront proceeds with no meaningful upside if the value of their work appreciates over time. To my friends at OpenSea: chalk this decision up as an experiment and then do right by the creators that make your platform valuable.

🫗 Silver(gate) Doesn’t Rust, But It’s Probably Going Bust

Silvergate has had a bad week. And by bad week, I mean that they probably haven’t had a good week since FTX collapsed.

A quick recap of all that happened before this week:

Silvergate saw $8.1B of investor withdrawals after FTX, one of its clients, collapsed in November. Unsurprisingly, Silvergate is being probed for how it handled funds attached to FTX and Alameda Research.

To cover those withdrawn funds, Silvergate had to sell off debt at a $718M loss

Those two developments contributed to a $1B loss for Q4, and turned what was a $76M profit in 2021 to a $949M loss in 2022.

Silvergate had to repay the $4.3B advance it received from the Federal Home Loan Bank.

Founded in 1987, Silvergate rose to prominence in recent years as it moved aggressively to support crypto businesses. Before going any further, that should be applauded — during a time in which few, if any, major banks in the US were willing to dive deep on crypto and understand the opportunities and challenges of serving its entrepreneurs, Silvergate leaned in to fill a needed and vital role as a crypto-friendly bank. If you’ve used Coinbase, Binance, FTX, or almost any other major crypto exchange, you’ve indirectly used Silvergate; at one point, they had 1,600+ crypto clients and facilitated ~80% of all funds that flowed in and out of the digital asset markets.

However, the last several months have seen sizable layoffs, massive losses, and an inescapable de-prioritization of their crypto business following FTX’s collapse. And to compound those problems, Silvergate’s crypto business line had done so well that it had become material to its success and prospects, making significant pullbacks there potentially catastrophic to the company.

Potentially has turned into reality.

This last week began with a growing number of crypto companies cutting ties with Silvergate, prompting ‘bank-run’ rumors. Defectors included Coinbase, Bitstamp, Gemini, Crypto.com, Circle, Paxos, and Galaxy Digital.

Those rumors were enflamed further when Silvergate delayed its annual report to the SEC, sharing that they needed more time to assess the damage to its finances following 2022’s crypto crash, and presenting disclosures about being ‘less than well-capitalized’ as they were ‘reevaluating [their] business.’ They even called into question their own ability to remain operational going forward, something that no publicly-traded company would admit to unless they were sitting on death’s doorstep.

And just in time for print, the coffin may have been delivered on Friday, when the company announced in a Friday evening news dump that they were shuttering their SEN Platform, a payments network that was used by all kinds of institutions to move money onto crypto exchanges.

To be very clear: Silvergate’s collapse is related to crypto but not directly caused by it. The primary reason the company is facing extinction is because it built a massive but (arguably and relatively) unreliable deposit base (crypto businesses) and did not hedge the duration risks that would be introduced should something go very wrong in crypto. FTX collapsing certainly fits the bill there.

🙄 The FTX Update

Sam Bankman-Fried is facing new criminal charges after a judge unsealed a new 12-count indictment against him last week. You have to respect the man’s commitment to collecting as many white collar crime charges as possible.

Sam’s friends aren’t doing much in the way of helping. Nishad Singh, FTX’s former director of engineering, pleaded guilty to a six federal charges, including a count of wire fraud and three counts of conspiracy to commit fraud. He was also with with separate charges from the SEC and CFTC.

Pleading guilty to the Feds likely means that Nishad is cooperating, joining other FTX executives in their growing friendship with the authorities. It’s shaping up to be a pay-per-view classic, with a mouthwatering headline event: SBF versus all of his former Bahamian bunkmates.

Other lowlights for our soon-to-be incarcerated friends:

Ruairi Donnelly, a former FTX executive, ran a charity (Polaris Ventures) to which he ‘donated’ his FTX salary in exchange for a preferential rate to purchase FTT tokens, turning ~$600K into $150M for the organization. Now that is how you altruism effectively.

The Department of Justice is alleging that Sam Bankman-Fried and FTX straw donors made tens of millions of dollars in illegal political contributions. Sounds more than plausible for Scammin’ Sammy.

🌪️ Regulatory Recap

The SEC adds more bodies to its enforcement division, as Gary makes it clear that regulation is something to be earned through punishment and force, rather than thoughtfulness and vision.

The Big G also shared his view that everything in crypto except Bitcoin is a security, ‘because you can find a website’ for them.

US banking regulators, including the Federal Reserve and other US agencies, warned banks that crypto poses significant liquidity dangers.

Here’s alternative view on the job that regulators have from Austin Campbell, a Columbia Business School professor. The short version is this: American regulators have a really difficult job, they are underpaid, receive lots of blame and little credit, and they often lack specialization, especially for novel, paradigm-shifting technology advancements. I appreciate all of that, and commend Austin’s willingness to call it out … as long as I can separate [Redacted] from all other regulators.

I genuinely appreciate the points that Austin makes, and would consider myself agreeable to most of them. And yet, I must present this counter-argument.

For those that don’t want to do math, $5M is about what they would earn in less than a week from interest payments if the entire $32B portfolio was invested in US Treasuries. (h/t @J264B in the replies for the quick math)

Other Bits

⛓️ Siemens, the largest industrial manufacturer in Europe, issued its first digital bond on a public blockchain (~$64M via Polygon) as the company looks to reduce intermediaries and access a wider pool of buyers. No paper certificates, no central clearing house, no middleman bank … not even any contact with the blockchain you executed this one (seriously). Check off another box in blockchain use case bingo.

🖇️ Hong Kong also issued a blockchain-based bond — specifically, a green bond designated to fund eco-friendly efforts — but it used a permissioned (read: private) blockchain built by Goldman Sachs. Cool use of the tech, but it’s like going to an authentic Mexican restaurant and ordering a hamburger.

😬 Binance shared that they are preparing settle with the Department of Justice and CFTC to ‘make amends’ for previous legal transgressions. They are also considering a move away from their US banking partners and a move to de-list USD-backed stablecoins in response to pressure from US regulators. And if you ask the SEC, their Binance.US business is operating as an unregistered securities exchange. Binance the next time they see an email from a .gov account:

🛑 To add insult to injury, stablecoin issuer Paxos has ended its relationship with Binance and Coinbase de-listed BUSD for (all of a sudden?) not meeting its listing standards.

👮 The SEC finally and officially charged Terraform and its CEO Do Kwon with defrauding investors. Do is rumored to be in Serbia. He allegedly siphoned 10,000 bitcoin from Terraform Labs after Terra/LUNA’s collapse.

🪱 The Wormhole exploit from 2022 has been ‘reversed', as Jump Crypto and Oasis partnered to counter-exploit the hack to recover 120,000 ETH that had previously been stolen. Sounds great? No. It actually introduces dangerous precedent, as the Oasis team used admin access to transfer ownership of the hacker's vault to Jump Capital. The definition of a slippery slope: doing this to punish bad actors and comply with government requests today, only to willingly (or through external coercion) do the same to not-so-bad actors tomorrow.

🎮 Top web3 gaming guild Yield Guild Games is raising a $75M venture capital fund to invest in early stage web3 gaming projects. You either die a company or live long enough to launch a venture firm.

🏨 The NoMo SoHo hotel in New York City has become the first hotel in the United States to offer NFT-based reservations.

👔 QG magazine is launching its first NFT collection that will grant access to magazine subscriptions, merchandise, and live events. Non-fungies got style.

🎶 Spotify is using NFTs to curate playlists. NFT tech isn’t a fad? Shiiiiiiit.

💅 A beauty brand owned by L’Oreal created a DAO to incubate and invest in 3D digital art projects.

🥷 Robinhood rolled out its self-custody wallet, which supports Ethereum and Polygon, to iOS customers worldwide.

🇺🇦 Ukraine has raised 44 times more in crypto donations than Russia in the one year since the illegal invasion. Don’t tell Senator Elizabeth Warren.

🚴♀️ Peloton’s Robin Arzón is building a web3 community around working out, called Swagger Society. That girl don’t do basic 💅.

✂️ Polygon Labs cut its staff by 20% in a move to consolidate. Dapper Labs, best known for NBA Top Shot NFTs, also laid off 20% of its staff for the second time in four months. It’s not bulking season yet; we’re still cutting.

🤕 If you thought you had a bad year, Multicoin Capital might have you beat: their hedge fund lost 91% of its value in 2022, driven by exposure to FTX, FTT, and Solana-based tokens.

📉 The US is losing its market share of crypto developers. This is what happens when a country tries to push back against a technology that grants permissionless access to anyone in the world.

🍁 The CEO of the Quebec pension fund, which invested in Celsius, a company run by a serial scammer and whose business model resembled a house of cards, gave an interview saying that his team would never invest into anything related to cryptocurrency again. ‘Due diligence is not a guarantee for success.’ Well, I guarantee that they will capitulate. We’ll welcome them back in at the top again in two years.

[Disclaimer: Any opinions expressed are solely my own and do not express the views or opinions of my employer. Because the information included in this newsletter is based on my personal opinion and experience, it should not be considered professional financial analysis or advice.]