7.1.22 [archives]

Another quarterly summary, a lot of stuff happened with BlockFi that ended in a deal with FTX, Grayscale takes on the SEC, and layoffs galore

We’re wrapping up our second quarter together so let’s take a break from the stories of contagion and hit on the quarter’s key themes. Feel free to scroll past the quarterly review if you’d rather not re-live the carnage from the past few months. There’s enough intrigue from BlockFi’s week alone. This week was a doozy.

☢️ Did I say we weren’t going to talk about the contagion? I lied. The fall of Terra … then Three Arrows Capital … and then Celsius … was the story. We’re still sifting through the rubble, waiting on news of additional lender, exchange, and startup failures. There is probably a crypto venture fund or two out there staring down the long and lonely road to dissolution. SBF seems to think there are already crypto exchanges that are ‘secretly insolvent.’ Fun. Nothing like stocking up on some hazmat suits for the summer, right?

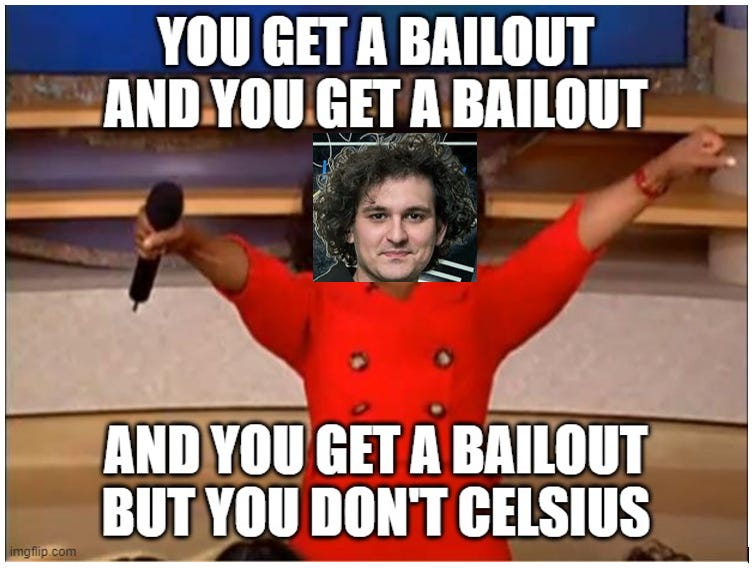

🌑 FTX has emerged as the industry’s altruistic Death Star, ready and capable to bailout and scoop up any company that may further their federational efforts. To recap: they made a strategic investment in IEX Group, bought a sizable position in Robinhood, launched commission-free stock trading on their platform, remain attached to every neobank acquisition rumor, actually did acquire a crypto trading platform in Canada, bailed out BlockFi, bailed out Voyager, and didn’t bail out Celsius. FTX might not even be close to done, rumored to be considering a new capital injection to bolster its armory. SBF is probably working some nights and weekends.

🏛️ The government is coming. Lawmakers are building the sandboxes while regulators are fighting to see who gets control of the $1T toy that is crypto. We have our first landmark crypto bill circulating and serious momentum for greater regulatory scrutiny and understanding. We still don’t have a spot Bitcoin ETF but you can now go short Bitcoin via ETF because investor protection remains a meme.

📉 The macro is bad because inflation is the highest it has been for decades and the Fed is signaling a fearless desire to hike rates and then hike them some more, even if they break a few things and welcome in a recession. The stock market had its worst first half of the year in 52 years. The macro is the story until further notice. Note to central bankers: you probably don’t want to be compared to Thanos in this way.

🖼️ NFTs saw a lot of foundational activity – OpenSea rolled out credit card payments, Solana NFTs, and technical improvements to cut gas fees, and Solana-based competitor MagicEden continues to see explosive growth – and seemingly every sports league and luxury brand has adopted them to varying degrees. NFTs are showing tangible evidence of helping existing brands connect with their consumers and new brands tap into alternative financing structures. Billboard’s CEO stepped down to become CEO of Doodles. We even saw the first nine-figure NFT-dedicated fund launch. But the macro has come for everything so our jpegggs are more like jpes … down some g’s. Come for the news, stay leave for the jokes.

🤝 Consolidation is coming to crypto. We saw the largest company acquisition in crypto’s history, FTX planted acquisition seeds across the industry, and OpenSea and Uniswap scooped up an NFT aggregator platform each. Market conditions suggest we should see an uptick in deals as leaders look to expand market share and product presence and smaller players band together to survive. We can’t have 500+ crypto exchanges running around trying to do this solo. Especially when almost all of them are doing it poorly right now.

👎 Coinbase just had about as bad of a quarter a publicly-traded industry leader can have. Failed NFT marketplace launch. Rescinded accepted offers and laid off more than 1,000 employees. Went after a couple acquisitions and didn’t close them. Missed earnings by 20%+ and went from profitable to a $430M quarterly loss. Stock price is down almost 75% for the quarter. Caused a bankruptcy panic by submitting a required regulatory filing. Announced new KYC requirements in Amsterdam and saw their deal to provide ‘geo tracking data’ to ICE resurface, two headlines that go against the ethos of much of their user base. Saw one large competitor drop spot bitcoin trading fees to 0% overnight and another act simultaneously as the modern-day John Pierpont Morgan and the live action version of Grand Moff Tarkin. It was a bad quarter. To be fair, they did launch several new products, dropped in some feature improvements, and became the first crypto company to enter the Fortune 500. But like a slumping baseball player, they have to be relieved for the turn of the calendar.

🪓 Crypto layoffs became commonplace, with many of the industry leaders announcing sizable headcount cuts. This is likely to continue for the foreseeable future as companies manage down expenses and prepare for more difficulty in the months and quarters ahead.

👑 We saw a second country adopt Bitcoin as legal tender with the Central African Republic joining El Salvador. We also saw continued pushback from environmental groups and lawmakers looking to limit Bitcoin mining in their respective regions. Bitcoin mining, as it always does, continues to chug along, even making some late-quarter clean energy inroads. This past month marked Bitcoin’s worst by performance since September 2011 and this quarter its worst since Q3 2011. Sheesh.

👨💻 We’re still hacking and exploiting. Capital lost to hacks totaled well above nine figures for Q2 and we’ve already joined the tres comas club year-to-date.

⛙ And we’re still waiting on the Ethereum Merge. Maybe next quarter, but probably not. But maybe.

Your tweet of the quarter, coming on the quarter’s third-to-last day:

BlockFi | There’s always a catch. FTX’s $250M credit offering to BlockFi, capital that would go to user assets before equity investors, could allow SBF’s empire to acquire BlockFi shares for $0 each. You don’t have to be good at the maths to know that’s a pretty devastating outcome for equity investors and shareholders. You also don’t have to be good at the human psyche to understand why a leaked call from one of BlockFi’s larger venture investors, Morgan Creek Digital, shared that the firm was seeking an alternative solution. Customer assets need to come before equity investors if this goes that direction, though I recognize that’s a lot easier said as someone without tens (hundreds?) of millions at stake. In the event the equity investors can put a competitive package together, it looks like BlockFi’s valuation will fall some 90% to below $500M … That last segment is what I wrote before it came out yesterday that FTX is closing in on buying BlockFi for $25M … but then then BlockFi CEO Zac Prince publicly refuted that … and then it came out that the offer was $25M in equity tacked onto the $250M credit line from last week. I think. Considering BlockFi went from ‘only trust what you hear from BlockFi and FTX’ earlier this week to ‘only trust what you hear from BlockFi’ yesterday, the tone seems to have shifted from sympathetic support to hostile takeover. BlockFi, the newest member of the Rebel Alliance … So help you if you thought that was this story’s last twist. Ledn, a Canada-based competitor of BlockFi’s, came up with a rather competitive offer late Thursday night: a $400M funding round, $50M of which would come in equity, with Ledn and ParaFi Capital writing the checks … And then this morning came and with it, a resolution: FTX’s deal won out, with BlockFi receiving a $680M package that includes a $400M credit facility and the option to acquire BlockFi at a variable price of up to $240M based on performance triggers. BlockFi’s CEO Zac Prince shared in a Twitter thread that the firm lost roughly $80M from its $1B loan to 3AC, a relatively modest sum considering the losses Voyager ($650M+) and Genesis ($100Ms) are reportedly facing. Even if ‘relatively’ is doing a lot of the lifting there, it’s worth calling out … It’s clear that FTX is doing everything possible to protect the industry from further loss of reputation and customers’ assets, while simultaneously building their empire.

Celsius | The embattled crypto lender is seeking a show of client support as their lawyers advocate for Chapter 11 bankruptcy. That seems likely … Celsius hasn’t yet resumed its withdrawals but at least the firm’s token, CEL, is up 5x since its lows two weeks ago … How bad is it for Celsius? The firm’s asset-to-equity ratio – 19:1! – was more than double that of a typical US bank when it raised funds last year. For the less financially-inclined, that is bad, bad. Even FTX, which has been handing out bailouts like candy on Halloween, walked away from helping the firm after seeing the state of its finances …

I imagine the users of centralized crypto lending services are learning quickly the difference between transparent, user-controlled products and those that function in black boxes but present a comfortable user interface. If only there was a group of people willing to de-fy the status quo to build those types of products.

‘The Contagious Others’ | Voyager Digital issued Three Arrows Capital with a default notice, though the firm conceded that they are unsure the amount they will be able to recover … Aaaand there it is, the Friday afternoon news drop: Voyager is temporarily suspending trading, deposits, withdrawals, and loyalty rewards … Crypto lender Nexo issued a cease and desist letter in an effort to silence an anonymous Otter on Twitter that published a series of tweets claiming that Nexo’s co-founders had siphoned funds from a charity for sick kids. Re-read that sentence. We can’t get past all of this quick enough … Genesis, the DCG-owned trading firm, is facing ‘hundreds of millions’ in losses due to exposure to Three Arrows Capital and Babel Finance. For now, the business continues to operate normally, though it’s hard to suggest anyone should be using the yield products these companies offer right now … If you were still holding out hope that Three Arrows Capital simply mismanaged capital and didn’t engage in criminal activity intentionally, it might be time to let that go: the Monetary Authority of Singapore (MAS) issued a notice that the firm provided ‘false information’ to the regulator … Meanwhile, a British Virgin Islands court ordered the firm to liquidate its holdings … Here’s an inside look at the Three Arrows Capital money machine … We’re now up to at least eight lenders, exchanges, and brokerages that have suspended customer withdrawals or are limiting services. BlockFi and Gemini are not included on that list, yet … It’s becoming more clear that while LUNA was the explosive trigger, GBTC might have been the slow knife that cut the deepest. As the SEC once again denied Grayscale’s application to convert GBTC to a spot Bitcoin ETF, there is growing sentiment that Grayscale should dissolve the fund and make investors both whole and liquid or pursue a Reg M exemption. Dissolving the fund is asking DCG, Grayscale’s parent company, to give up $100Ms in annual revenue so … don’t count on it. Maybe the SEC could have done something, which brings us to …

The SEC vs. GBTC | The SEC rejected Grayscale’s application to convert its Grayscale Bitcoin Trust (GBTC) product into a spot-based bitcoin ETF, citing that the application failed to answer the SEC’s questions about preventing market manipulation. Of course, the SEC didn’t share any detail on how these market manipulation concerns don’t also apply to the various futures and inverse spot ETF products they have already approved. GBTC is trading at a 30%+ discount to NAV, a discount representing roughly $8B in unrealized shareholder value, and sits at the center of the crypto lending debacle covered in too many words above, at least in part because of that discount. A spot-based ETF is unquestionably a better product for investors. When does that comforting protection from regulators kick in again? … Grayscale responded immediately, filing a lawsuit against the SEC. The firm argues that the SEC is ‘acting arbitrarily and capriciously’ in its treatment of similar investment vehicles. Here’s a Twitter thread from FTX’s President that dives into the inconsistencies of the SEC’s decision. Gary Gensler, get ready to step into the (proverbial) ring against Don Verrilli.

Bitcoin | Almost $4B in loans backed by Bitcoin mining rigs are now underwater, bringing another risk vector to the crypto lending community. The light at the end of the lending-related tunnel seems dim and distant … Say what you will about Michael Saylor but the man has conviction. Either that or an obsessive need to own every bitcoin in existence. His company, MicroStrategy, disclosed buying another 480 bitcoin for roughly $10M. This brings the company’s holdings to nearly 130K bitcoin, worth a hefty $2.6B. He will look like a forward-thinking savant if he survives this bear market, and something a lot worse if he doesn’t …

VanEck has filed a new application with the SEC for its spot Bitcoin ETF. You miss every shot you don’t take, I guess … The Bank for International Settlements is moving to allow banks to hold up to 1% of their reserves in cryptoassets like Bitcoin. The BIS has previously taken a skeptical approach to digital assets.

Regulatory | SEC Chair Gary Gensler reiterated his belief that Bitcoin is a commodity, separating it from the rest of crypto, choosing not to comment on the security status of other assets. Going against his predecessors and other regulatory agencies, Gary refuses to extend that same courtesy to Ethereum, let alone other tokens. That seems like convenient thinking for a man who can see power slipping from his grasp.

The EU has finalized its massive Markets in Crypto-Assets (MiCA) bill, the region’s first attempt at a comprehensive regulatory framework for digital assets. Two parts are getting publicity: that ‘un-hosted wallets’ owned by individuals will need to be reported if the amount tops the €1,000 threshold and that the ‘EU is not happy about stablecoins generally’ and that may come through in this bill. If the regulators are regulating, they are doing so because it is both important and inevitable. That’s called #alpha.

Around the World | The maximum amount of foreign currency a person in Sri Lanka is allowed to hold has been reduced to $10,000. In related news, Turkey now restricts lending to companies that hold foreign currencies. I wonder what the market is for a self-custodial, self-sovereign money.

Stablecoins & CBDCs | Democratic Congressman Jim Himes of Connecticut issued a report calling on Congress to ‘begin the process of considering and ultimately passing authorizing legislation for the issuance of a US CBDC.’ I maintain my longstanding position that CBDCs could have some redeeming qualities but the chances of those shining through without also inviting mass personal finance surveillance seem miniscule. I also maintain that CBDCs could accelerate the normalization of digital asset wallets and therefore indirectly accelerate the adoption of cryptoassets, particularly if belief in institutional powers continues to wane.

NFTs | Chia, a layer-1 blockchain that claims to be an ‘eco-friendly’ alternative to Bitcoin and Ethereum, launched NFTs on its blockchain. The NFT wars are here … Leading crypto hardware firm Ledger is launching an NFT marketplace and web3 services platform for enterprises. The firm is also rolling out a suite of other products focused on web3 education and security … Facebook launched an NFT feature for a select group of US creators. Zuck Bucks! … The NFT market may see its first sub-$1B volume month in a year. I maintain my staunch belief in NFTs on a ten-year view, though the one-quarter review is admittedly bleak.

Financings & Fundraises | Citadel’s global head of business development is leaving the market-making giant to launch a crypto marketplace backed by Virtu Financial, Charles Schwab, Sequoia, and Citadel itself. All the signs for this have been there for months … Kaiko, a crypto market data provider, announced a $53M Series B financing round led by early Alibaba-backer Eight Roads … PolySign, a crypto startup that offers custody, trading, and administration infrastructure for institutions, raised a $53M Series C round … eToro, an Israel-based online brokerage offering cryptocurrency and stock trading, is abandoning its plans for a SPAC merger. If you think crypto has been down bad recently, let me tell you about the SPAC market … Nick Tomaino of 1confirmation announced that the firm has raised $100M for its NFT Fund. It may be the first such fund – one dedicated exclusively to supporting NFT projects – and it is almost certainly the first at its size. We don’t bet against Nick … FTX-backer Race Capital has raised $150M for their second fund … Early-stage Solana-backer Reciprocal Ventures announced their $70M fund … Ship Capital is rebranding their developer collective into a venture fund called Protagonist, having raised at least $33M … OP Crypto is raising $100M for a crypto fund of funds – a vehicle that will build a portfolio of crypto venture funds.

Bits | While there was news of FTX exploring an acquisition of Robinhood early in the week, FTX founder and CEO Sam Bankman-Fried publicly denied those rumors, instead hinting at possible partnerships. It seems Robinhood’s independence has been spared, for now. It’s probably best for our hooded friend to sleep with one eye open and a quiver close by … Less than 1% of all cryptoasset holders have 90% of the voting power in DAOs. Maybe we should call them CAOs? So much for that moo-vement 🐄 ... Hedge funds are betting big against Tether, believing crypto’s largest stablecoin issuer is at risk following the collapse of UST. A Tether collapse is the boogeyman crypto does its best to ignore. For what it’s worth, Tether’s CTO fought back. The recent history of crypto founders fighting back ‘FUD’ on Twitter isn’t great (see: Terra; see: Celsius) but Tether has been a target for so long that I’m going to have to see it fail to believe it … Institutions can now stake their Ethereum on Anchorage Digital. The infinite duration ‘Internet Bond’ thesis nears its time in the sun … Ledger has added yield-earning capability that will allow users to put their cryptoassets to work from the safety of their hardware wallet. Hardware wallets can’t help against counterparty risks, though, as I hope we all now understand … Harmony, the blockchain bridge that was hacked for $100M last week, tweeted their offer of a $1M bounty for the return of the stolen crypto. It might just be me but if that’s your opening offer, I wouldn’t count on getting those assets back … Early Bitcoin investor Roger Ver allegedly owes crypto exchange CoinFLEX $47M. So the exchange, which halted withdrawals last week, turned his debt into a token and is selling it to customers, promising a 20% APY on it, to raise funds. This is how ponzis are born. Ver seems to think that CoinFLEX actually owes him the $47M. I’m tired …

Arthur Hayes shares his thoughts on the lessons we should be learning from this crypto bear market, his third such downward dance.

Sad Bits | Compass Mining, a company that hosts mining machines for individual clients, saw its CEO and CFO resign following ‘multiple setbacks and disappointments’ … Australian crypto firm Banxa is cutting 30% of its headcount as it prepares for another crypto winter … European crypto exchange Bitpanda laid off more than 200 people, cutting roughly 25% of its staff … Crypto exchange Huobi says layoffs are a ‘possibility.’ Reading between the lines: they are coming … OSL, a licensed crypto exchange based in Hong Kong, joins its brethren in announcing a round of layoffs, cutting roughly 15% of its workforce … Abra, a crypto trading and lending platform that recently launched the first crypto rewards card on the Amex Network, is laying off 5% of its workforce ‘purely as a cost-saving measure’ … I missed this from late-May but making sure all the i’s get dotted: Argentinian crypto exchange Buenbit let go of roughly 80 individuals, or 45% of its headcount.

Chris Dixon, GP at a16z Crypto, published a short write-up on his lessons from the 2000s, Toys, Secrets, and Cycles: Lessons from the 2000s, touching on the similarities between the early days of the internet and web3 today. My favorite data point: people spent 30 minutes online per day back in the early 2000s and now they spend 7 hours. Who are the deacons of discipline spending less than 7 hours per day on the Internet in 2022? Chris also shared that ‘the mainstream consensus back then was that the internet was a cool invention, but had limited use cases, and probably wasn’t a good place to build a business’ … what present-day example does that remind you of?

This entire week summed up in one GIF:

Source Code

Morgan Creek Is Trying to Counter FTX’s BlockFi Bailout, Leaked Call Shows:

A leaked investor call revealed Morgan Creek's bid for BlockFi. Here are four more big takeaways from the call:

FTX closes in on a deal to buy embattled crypto lender BlockFi for $25 million in a fire sale:

Crypto Lender BlockFi, in Talks With FTX, Also Gets Ledn Offer:

Celsius seeks show of client support as lawyers push for Chapter 11 bankruptcy:

Voyager Digital Issues Three Arrows Capital With Default Notice:

https://decrypt.co/103892/voyager-digital-issues-three-arrows-capital-default-notice

Nexo threatens legal action against anonymous Twitter account:

https://www.theblock.co/linked/154252/nexo-threatens-legal-action-against-anonymous-twitter-account

Genesis Faces ‘Hundreds of Millions’ in Losses as 3AC Exposure Swamps Crypto Lenders:

Singapore Regulator Reprimands Three Arrows Capital for 'Providing False Information':

Crypto Hedge Fund Three Arrows Ordered by Court to Liquidate:

https://www.wsj.com/articles/crypto-fund-three-arrows-ordered-to-liquidate-by-court-11656506404

SEC Rejects Grayscale’s Spot Bitcoin ETF Application:

https://www.coindesk.com/policy/2022/06/30/sec-rejects-grayscales-spot-bitcoin-etf-application/

Grayscale files suit against SEC following rejection of GBTC conversion bid:

Almost $4 Billion in Bitcoin Miner Loans Are Coming Under Stress:

Michael Saylor's MicroStrategy Purchased Another $10M of Bitcoin Over Past Two Months:

Bank for International Settlements to allow banks to keep 1% of reserves in Bitcoin:

Bitcoin is the only coin the SEC Chair will call a commodity:

https://www.axios.com/2022/06/28/bitcoin-is-the-only-coin-the-sec-chair-will-call-a-commodity

Rep. Himes Argues Congress Should Begin New Legislation To Authorize CBDC:

Chia Aims to Take on Ethereum, Solana With NFTs. Will They Blossom?:

https://decrypt.co/104049/chia-aims-take-ethereum-solana-nfts-will-they-blossom

Ledger Launches NFT Marketplace and Services Platform for Enterprises:

NFTs Have ‘Fallen Off the Cliff’ as Sales Sink to Lowest Levels in a Year:

Citadel Securities veteran will head new crypto ‘trading ecosystem’ whose backers include Sequoia, Charles Schwab:

Crypto Data Firm Kaiko Raises $53M, Defying Bear Market:

https://decrypt.co/103964/crypto-data-firm-kaiko-raises-53m-defying-bear-market

Crypto infrastructure firm PolySign raises $53 million in Series C funding:

https://www.theblock.co/post/154508/polysign-raises-series-c-funding-crypto-infrastructure

Nick Tomaino says NFTs will ‘flip cryptocurrencies,’ launches new $100M fund:

Solana’s Macalinao Brothers Double Down on Crypto Venture Fund:

Less than 1% of all holders have 90% of the voting power in DAOs:

https://cointelegraph.com/news/less-than-1-of-all-holders-have-90-of-the-voting-power-in-daos-report

More Hedge Funds Are Betting Against Tether as Crypto Melts Down:

Anchorage Digital Announces Ethereum Staking For Institutions:

https://decrypt.co/104001/anchorage-digital-announces-ethereum-staking-for-institutions

Ledger Live Adds Yield Earning Capability via Alkemi Earn:

Harmony offers $1 million bounty for return of stolen funds:

https://www.theblock.co/linked/154243/harmony-offers-1-million-bounty-for-return-of-stolen-funds

CoinFLEX CEO accuses investor Roger Ver of defaulting on $47 million loan:

Number Three:

https://cryptohayes.medium.com/number-three-511f334d8fae

Compass Mining CEO and CFO resign as company cites 'multiple setbacks and disappointments':

Australian Crypto Firm Banxa to Cut Staff by 30% Citing ‘Another Crypto Winter’:

https://decrypt.co/103891/australian-crypto-firm-banxa-cut-staff-30-citing-another-crypto-winter

European Crypto Exchange Bitpanda Cuts Staff by Hundreds:

Crypto exchange Huobi says layoffs are a 'possibility':

https://www.theblock.co/post/154495/crypto-exchange-huobi-says-layoffs-are-a-possibility

Hong Kong's OSL becomes the latest crypto exchange to cut jobs”

https://www.theblock.co/post/155026/osl-layoffs-crypto-exchange-hong-kong

Abra becomes latest crypto firm to cut jobs:

https://www.theblock.co/post/155209/abra-becomes-latest-crypto-firm-to-cut-jobs

Argentinian Crypto Exchange Buenbit Cuts 45% of Staff Due to Tech Industry Downturn:

[Disclaimer: Any opinions expressed are solely my own and do not express the views or opinions of my employer. Because the information included in this newsletter is based on my personal opinion and experience, it should not be considered professional financial analysis or advice.]