7.13.24

Bullish on Bitcoin and crypto and you should be, too

Crypto prices are taking a (big) break so let’s hit on the state of crypto then check in on Bitcoin and Ethereum. We’ll sprinkle in some adoption hopium at the institutional level. We won’t discuss memecoins, not because they are destructive to the industry, but rather because they have been destructive to my PnL.

Quick Check In

If you’re reading this and don’t own crypto or own a negligible amount … I’m begging you to get off ~zero. Begging. As a grown man. For the sake of your own 2025 sanity.

I am bullish.

State of Crypto, Sponsored by Coinbase

This actually is sponsored by Coinbase. Not because they’re paying me or even know this publication exists, but rather because they hosted a summit on the state of this beautiful, dark, twisted industry. We’re a month late to this (something about working at a startup going out of business) but the takeaways are required reading nonetheless.

Some overarching thoughts:

Institutional players dominated the guest list – brokerages, pensions, endowments, asset managers, banks, and the like.

The upcoming generational wealth transfer is real – $70T from boomers (the people who saved up a few months of salary in 1990 to buy a home that is now worth $5M and fully paid off) into the hands of not-boomers (the people who only get to visit these $5M homes on their DoorDash route). An overwhelming majority of these non-boomers are disillusioned with the existing financial system. Unsurprisingly, this cohort is far more interested in crypto.

More than 30% of the top 100 hedge funds in the world are onboarded with Coinbase. Maybe some of them can stop shorting our precious Bitcoin and stand with the common people for once.

There are 4B people around the world going into an election cycle, and crypto is high on the global political agenda … apparently, people are realizing that crypto will be part of the global economy.

From BlackRock’s CIO of ETFs/Index Investments:

Demand for Bitcoin ETFs forced BlackRock’s hand – they couldn’t not do it. And before you say ‘institutions!’ … 80% of BlackRock’s Bitcoin ETF inflows is coming from self-directed investors buying through their own brokerage accounts (read: individuals). We been grassroots with it from the jump. Maybe some of these institutions – so-called ‘smart money’ – can start helping us out. We’ll push Bitcoin to $100K ourselves, but we’d prefer to save our backs and bank accounts in the process.

BlackRock is a tokenization maxi. To paraphrase: ‘the tokenization of everything feels obvious.’ This is BlackRock saying this. The only thing more bullish is if, I don’t know, the President of the US said something about restoring the rights of Bitcoin users. Can you imagine?

Crypto has a branding problem. You don’t say.

Both Coinbase and BlackRock have clients waiting on the sidelines waiting for regulatory clarity. Paging Gary Gensler (or is he too busy packing his office into a banker’s box?).

From a fireside chat between Brian Armstrong (The Based God) and Cathie Wood (CEO of Ark Invest):

‘The biggest obstacle for crypto is regulatory clarity.’ Where have we heard this before? It was posited that if and when we get that clarity, institutions will level-up from 1-2% of exposure to 5-10%. You don’t have to be a math person to understand the directional impact there.

Retail has led this industry historically but institutions are now here, including more than 50% of Fortune 500 companies working on something onchain. I’m not sure I care about Home Depot putting two-by-fours onchain but it’s good for the narrative!

Coinbase is moving all of their products onchain … centralized exchange of value is a ‘moment in time’ need but the future will be dominated by peer-to-peer exchange without intermediaries. Bald-headed Brian gets it.

Some quotables:

‘If someone says blockchains are great but tokens are scams, that’s cognitive dissonance.’ Hang this in the Louvre.

‘Institutions are essentially short crypto because the ability to buy is there and they’re not pushing the buttons.’ Hang this up there, too. Not buying and/or participating in crypto is now an active decision against it. Institutions don’t take active decisions – even if that means doing nothing – without a thesis.

Bitcoin, and a Touch of Ethereum

When Bitcoin was days away from receiving its ETF approvals, I said in no uncertain terms that buying ‘one bitcoin at $43,000 or $45,000 or $40,000 greenbacks is mispriced, on both a short- and long-term perspective’. I do not care about the recent price action; I remain not uncertain. Being bearish sounds smart, but history is written by the bullish.

It would be nice if the institutions waiting on the sidelines – presumably waiting for Gary Gensler to unceremoniously slink away into the shadows of a forgettable existence – put their shoes on and got in the fucking game. All of us poors carried this thing from anonymous birth to a trillion-dollar market cap, and now we’re the ones supporting it against apocalyptic government sell walls to ensure it will make its glorious run to Valhalla. Bitcoin remains the people’s coin.

Let’s quickly walk through the bear case. You’ll notice both of these items seem decidedly lacking in long-term substance …

Germany just speedran their Bitcoin dump, getting rid of confiscated assets quicker than a two-strike drug dealer during a raid. They held ~50K bitcoin a few weeks ago, and had fully emptied the clip by July 12th. They sold 42K bitcoin in a week, an average of ~250 bitcoin per hour. Pardon my German, but that’s a metric fuckton of bitcoin unloaded in a very short amount of time. We survived.

Because nobody can maintain a bullish sentiment for more than a few hours, Mt. Gox FUD – up there with Tether as the oldest FUD in the books – is widely viewed as an imminent mass-sell event. I’m sure the people who have waited nearly a decade for their assets will dump them immediately upon receiving them, six months after Bitcoin ETFs were approved and three months after the halving. The base case should be that a meaningful percentage of these assets do get sold over the intermediate term, but likely spread out over several months, allowing the market to absorb it.

What’s the not-bear case?

Individual investors, boomers, and the institutions that are awake at the wheel are slurping the dip on Bitcoin via those new, shiny Bitcoin ETF vehicles. Trillions of dollars are supposedly ‘sidelined’, waiting for a pullback and attractive entry; Bitcoin being down ~25% from its modest new all-time high qualifies.

Speaking of those boomers, us millennials do have to give credit where it’s due: Bitcoin had a nasty month of price action but inflows hung in there with Bitcoin ETF AUM still growing month-over-month. A dip in net flows would have been understandable, but buyers hanging in during painful drawdowns is hardcore, and more important than only supporting when money is cheapest. This is how you earn your stripes.

Bitcoin’s Fear and Greed Index sits at ~29, the lowest mark since early January 2023. You may remember early January 2023 as that time when we as an industry we’re still picking through the rubble and finding the remains of our fallen soldiers in the wake of the FTX collapse. A single crypto-related ETF wasn’t even laughable, because to be laughable somebody would have to have the stones to suggest it in the first place. And sentiment today is similar to then. Really, seriously think about that.

Ethereum ETFs are expected to launch within the next few weeks, if not sooner, yet the price of ETH has dipped back below it was before the ETF approvals hit. The SEC dropped its (sham) case against Ethereum, solidifying its standing as a commodity. And yet nobody wants to bid this thing, even after we just ran this playbook (hype on approvals, faux-fear into launch, more inflows than expected immediately) with the Bitcoin ETFs? It’s a smaller scale game than Bitcoin but we’re also dealing with a much smaller denominator (~$370M market cap vs. Bitcoin’s ~$900M at ETF launch).

The Fed is getting ready to cut. The market is pricing in a 70% chance of a cut in September. That number could jump by the end of the month. In the world of investing, the two words you never say are ‘always’ and ‘never’ … but we are getting a cut at some point in the intermediate future. Election season and inflation numbers cooling (supposedly, but let’s not argue until we re-price our risk assets) means we’re knocking on the door of another worldwide easing cycle. That typically results in a spark for risk assets, and fireworks for risk assets that double as sound money.

Donald Trump is the favorite for the presidency and has a Republican party behind him that is bringing a comprehensively positive approach to crypto – including ending the crackdown on crypto, standing against CBDCs, and maintaining and restoring rights for Bitcoin miners, self-custody, and transacting freely. By the way, the orange man just announced he is speaking at the orange coin’s largest conference in a few weeks. I’m sure that won’t be bullish at all.

Speaking of the US government, they may be sitting on a stack of corn that is destined for the orderbooks but they also need to safeguard it in some way … so the Department of Justice recently inked a deal with Coinbase, putting their trust in the based one to hold those assets. You may be thinking, ‘the same Coinbase that the SEC attacks relentlessly? It couldn’t possibly be that Coinbase, because that wouldn’t make sense … why would the DEPARTMENT OF JUSTICE use a company that the SEC believes is irredeemably unlawful and a violator of the American people?’ Yes, my child.

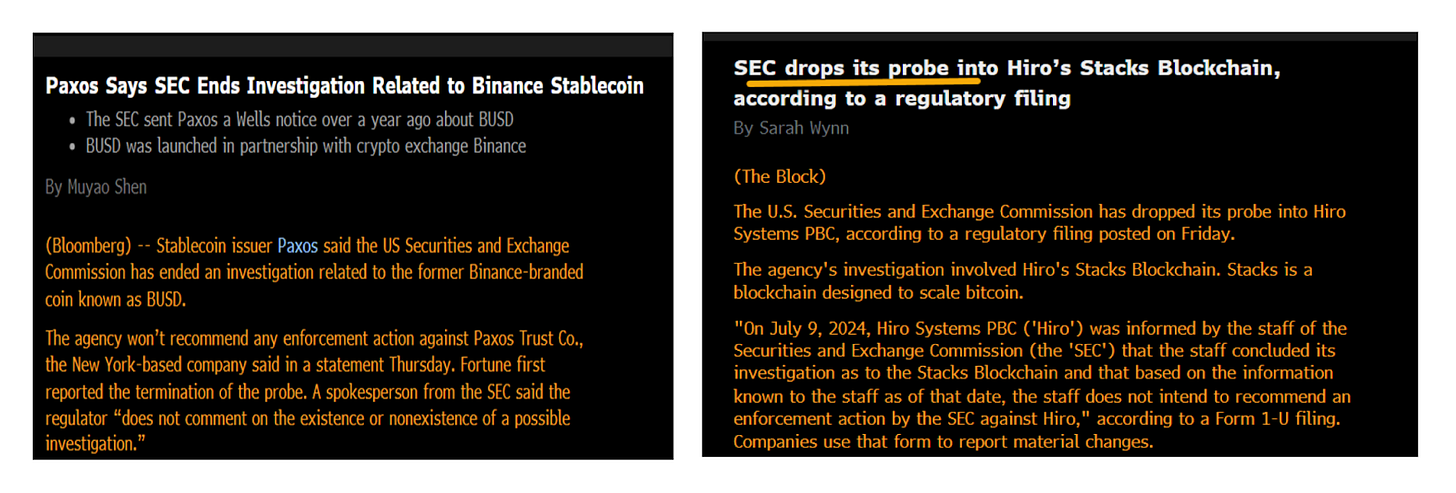

And then you have the growing stench of capitulation: in addition to dropping its sham case against Ethereum, the SEC also dropped its sham case against Paxos and the launch of Binance-branded stablecoin BUSD and its sham probe into Stacks Blockchain.

Out of respect for superstition, we don’t use the word supercycle … but you won’t catch me fading the most reflexive risk-on asset that (a) just received institutional validation, (b) is going into an easing cycle, and (c) will benefit from a likely administration change and the corresponding one-eighty on policy approach. This is no time for fear.

Quick Hitters

Robinhood announced their acquisition of UK-based crypto exchange Bitstamp for $200M. This is how a public company moving all-in on a large, emerging opportunity begins.

Coinbase announced a partnership with Stripe, one of the largest payments companies in the world. The partnership will launch with several key integrations designed to increase onchain adoption and provide faster, cheaper financial infrastructure: Stripe is adding support for USDC on Base to their crypto payouts and crypto onramp products, and Coinbase is adding Strip’s onramp product to their Coinbase Wallet offering, which will allow people to buy crypto instantly with credit cards and Apple Pay.

BlackRock and Citadel announced that they are launching a new stock exchange in Texas. If you’ve been paying attention to what the leaders of these two firms have been saying for the past year, you’d think the same thing I do: it seems inevitable that this exchange will support tokenized securities, possibly using that innovation to eat into the market share of larger exchanges. Starting a stock exchange business is inherently challenging, so the base case here is probably failure, but more competition is healthy, and moonshots are needed.

NCAA 25 is here so it’s time to restore the purple and gold to their dynastic glory.

Disclosure: All views shared are definitely my own. If you read my writing and somehow still interested in hiring me, let me know.