7.24.24

Ethereum ETFs go live, giving us another excuse to push Pudgy propaganda

Ethereum ETFs Are Here

On Monday, the SEC continued their cowering capitulation, approving Ethereum ETFs for trading. And yesterday, on Tuesday, we had real, live Ethereum ETFs. The streets are saying that Gary Gensler will be pushed out once President Biden’s term is over. Nature is healing.

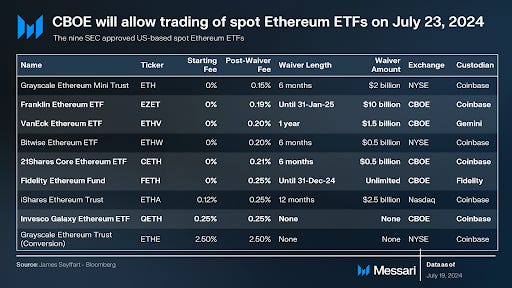

Here is the Ethereum ETF menu for those looking to indulge themselves:

Similar to when Bitcoin ETFs began trading, this is a landmark moment for Ethereum, and for crypto more broadly. The mere existence of Ethereum ETFs validates much of what the crypto industry has been building toward – ‘the tokenization of everything’ – and provides traditional investment dollars with a vehicle to bet broadly on the proliferation of digital assets and stablecoins, rather than the (relatively) narrow (but still incredibly important, and massively large) idea of sound, sovereign money that Bitcoin represents.

And as Bitcoin ETFs opened the door for their Ethereum brethren, Ethereum ETFs have now done the same for other assets. No asset was getting an ETF until Bitcoin received one, but now the floodgates are wide open: all blockchains and assets (even the memes) have a path to that sweet, succulent institutional bid. Get ready to develop an encyclopedic knowledge of crypto ETF tickers over the next few years. Proof: several ETF issuers have already filed for Solana ETFs.

Most traditional finance analysts are calling for flows into Ethereum ETFs to be ‘small potatoes’ compared to Bitcoin, which kind of depends on your potato comparison: reds to russets or fingerlings to yukon golds? Nobody in crypto is calling for Ethereum ETFs to outperform Bitcoin ETFs on flows – at least in the intermediate term – but my bet is that we surprise tradfi to the upside again. TradFi media may understand Apple’s quarterly earnings well, but I’m not sure I’d put much, if any, weight into their crypto analysis and prognostications.

While Bitcoin ETFs were (and still are) novel, Ethereum ETFs will benefit from the overwhelming demonstration of relevancy that Bitcoin ETFs delivered. Seeing that first wave of institutional demand break records and pull in more than $60B in AUM in six months means that institutions don’t need to necessarily wait for proof of concept before going after market share. The concept has been proven; now is not the time for issuers to rest on their laurels.

(For what it’s worth, the first day of Ethereum ETF trading saw nearly $1.3B of volume and net inflows of ~$107M, an impressive figure considering that nearly a half-billy fled from Grayscale’s bloated Ethereum Trust product. BlackRock and Bitwise brought in $267M and $204M, respectively. That’s a rock solid first day.)

ETH as an asset will also benefit from its supply dynamics – while Bitcoin has consistent inflation through miner rewards, Ethereum’s inflation is smaller (and at times it is deflationary) and a meaningful percentage of its outstanding supply is locked for staking. This, in addition to the mathematical fact that Ethereum has a far smaller denominator than Bitcoin to begin with should push the price of ETH upwards faster, if flows are strong. And we all know that the best marketing that any investment vehicle can have is ‘number go up.’

In short, the bull case for Ethereum:

an investment in an Ethereum ETF gives you exposure to a wide variety of crypto-enabled innovation — stablecoins and payments, the tokenization of assets, digital art and NFTs, decentralized finance primitives, and more is getting built on Ethereum — and an asset which accrues value through the fees used to pay for its usage and activity;

and if it receives even a fraction of the flows that Bitcoin ETFs have seen – remember, Bitcoin ETFs have been the most successful launches in ETF history – it will be undeniably positive for an asset that is ~one-third the size of Bitcoin and has a potentially deflationary monetary policy (the more activity on Ethereum, the more ETH that is burned forever, decreasing supply).

Regardless of whether Ethereum comes out of the gates popping off like fireworks or if the fuse requires a slow burn to get going, the bid will eventually be there because Ethereum also has something traditional investors crave: native yield. These Ethereum ETFs won’t include staking today, but they will eventually, and that is when all will bear witness to the convergence of the underexposed crypto curious and their addiction to yield.

With all of that said, I’m not sure what it says about Ethereum that one of its largest ETF issuers is choosing to rely on the cuteness of Pudgy Penguins to sell it. I think this is a great ad — though I wish my Pudgy had made it past auditions — but what this tells me more than anything else is that Pudgy Penguins are carrying Ethereum to institutional relevance and mass appeal. It just so happens that the Pudgy Penguins team just announced an $11M fundraise to build its own L2, because the answer to getting people to use crypto is always another blockchain. (Peter Thiel buying my bags, just as it was meant to be.)

For those who weren’t in the trenches six months ago when the Bitcoin ETFs launched, the leading Bitcoin NFT collections — e.g., Nodemonkes, Bitcoin Puppets — exploded from ~zero to $100Ms in market cap in a matter of weeks. The Bitcoin community finally got around to launching fungible tokens (e.g., BRCs). Marathon, a publicly traded Bitcoin mining company, announced plans to build a Bitcoin L2. That’s what an ETF can do for a blockchain’s ecosystem.

Capital invested in an ETF doesn’t make its way neatly onchain like that which is onboarded through a Coinbase account. But ETFs bring attention and buy pressure (i.e., number go up). As the most accomplished NFT project in all of crypto, Pudgy Penguins are the ETH beta you’ve all been looking for. You’re welcome.

Overton Windows

The Overton Window is on the move. While Donald Trump has been lauded as the pro-crypto candidate — particularly when compared to the Biden Administration — he may not be the only presidential candidate to speak at Bitcoin 2024 this week.

If you haven’t heard, Vice President Kamala Harris has had a busy start to the week, what with (seemingly) securing the Democratic presidential nomination and all. Yet she somehow found time to explore hard pivoting away from her party’s longstanding anti-crypto stance, beginning by looking for a way into one of the crypto industry’s largest annual conferences.

The context here is what is most important: there are hundreds (thousands?) of items that VP Harris could have focused on in her first hours as the Democractic presidential nominee, and she included a repositioning on crypto as one of the priorities. If her campaign runs on a friendlier approach to crypto, the Overton Window will have permanently shifted. This moment has seemed inevitable (to me) ever since Trump declared himself ‘the crypto candidate’ several months ago: we will likely have two presidential competing to win the crypto vote. Your price targets likely require revision.

[Update: VP Harris will not be attending or speaking at Bitcoin 2024. I still believe that she will, at the very least, gravitate toward the center on crypto, rather than remaining blindly loyal to the anti-crypto approach of her party’s leadership, seeing as how that strategy will only continue to hand over votes to Republican nominee Donald Trump.]

Institutions & Adoption

It also doesn’t hurt when the CEO of the largest asset manager in the world gets on TV and does this:

Larry Fink’s appearance on CNBC with Jim Cramer last week was as good an ad for Bitcoin as you’re going to find. He even admitted to being wrong about Bitcoin and — gasp! — being willing to change his mind once epiphany struck. If Larry Fink, the CEO of BlackRock, can maintain an open mind about his Bitcoin skepticism, you can, too.

Sticking with the institutions, State Street, the fourth-largest asset manager in the world with $4T in AUM, is looking into creating a stablecoin and deposit token as it looks at getting into crypto settlements options. Nobody can escape the tokenization of everything.

Moonshot, a new crypto mobile app, launched this past week. It is designed to make the onboarding process into crypto as easy as possible, becoming the first app on the App Store that lets you buy and sell memecoins and other tokens directly with Apple Pay. All it takes is an email and FaceID and you’re in — no seed phrases, no blockchain jargon. Just fun at your fingertips. If this is to be the cycle of institutions and mainstream adoption, more crypto products need to take this kind of approach.